The world of decentralized finance (DeFi) is step by step increasing to embody a major share of the worldwide monetary lending area by advantage of the inherently trustless method of operation and the benefit of accessing capital. Because the crypto ecosystem has grown to a $2-trillion business by market capitalization, new merchandise and choices have emerged because of burgeoning innovation in blockchain expertise.

Lending and borrowing have change into an integral a part of the crypto ecosystem, particularly with the emergence of DeFi. Lending and borrowing are one of many core choices of the normal monetary system, and most of the people are acquainted with the phrases within the type of mortgages, pupil loans, and so forth.

In conventional borrowing and lending, a lender gives a mortgage to a borrower and earns curiosity in trade for taking the danger, whereas the borrower gives property comparable to actual property, jewellery, and so forth., as collateral to acquire the mortgage. Such a transaction within the conventional monetary system is facilitated by monetary establishments comparable to a financial institution, which takes measures to attenuate the dangers related to offering a mortgage by conducting background checks comparable to Know Your Buyer and credit score scores earlier than a mortgage is authorized.

Liquidity has pushed DeFi’s progress up to now, so what’s the long run outlook?

Borrowing, lending and blockchain

Within the blockchain ecosystem, lending and borrowing actions will be carried out in a decentralized method whereby the events concerned in a transaction can deal immediately with one another with out an middleman or a monetary establishment by sensible contracts. Sensible contracts are self-executing pc codes which have a sure logic the place the principles of a transaction are embedded (coded) in them. These guidelines or mortgage phrases will be mounted rates of interest, the mortgage quantity, or contract expiry date and are mechanically executed when sure situations are met.

Loans are obtained by offering crypto property as collateral on a DeFi platform in trade for different property. Customers can deposit their cash right into a DeFi protocol sensible contract and change into a lender. In return, they’re issued native tokens to the protocol, comparable to cTokens for Compound, aTokens for Have or Dai for MakerDao to call just a few. These tokens are consultant of the principal and the curiosity quantity that may be redeemed later. Debtors present crypto property as collateral in trade for different crypto property that they want to borrow from one of many DeFi protocols. Normally, the loans are over-collateralized to account for surprising bills and dangers related to decentralized financing.

Trying to take out a crypto mortgage? Right here’s what that you must know

Borrowing, lending and complete worth locked

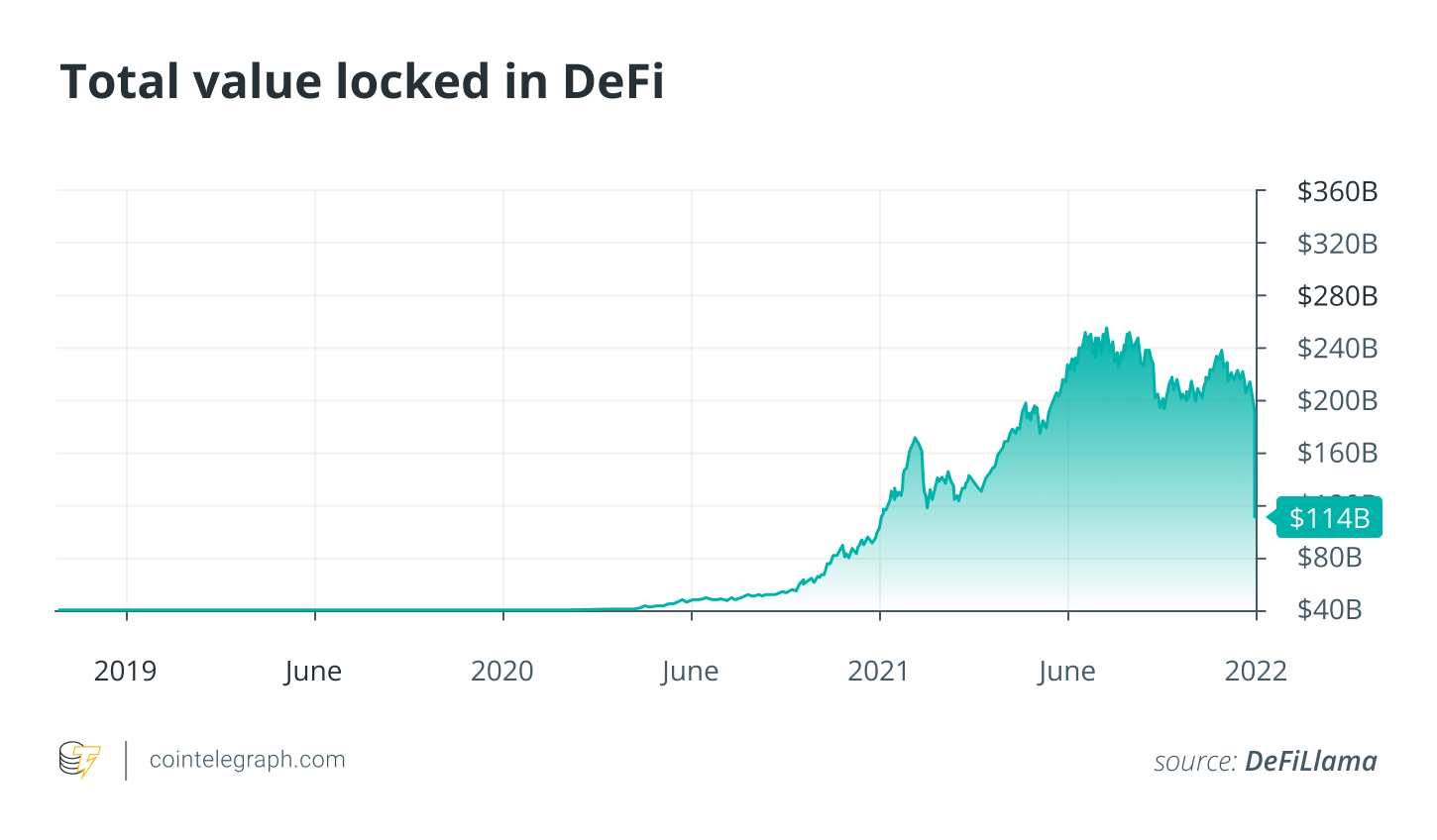

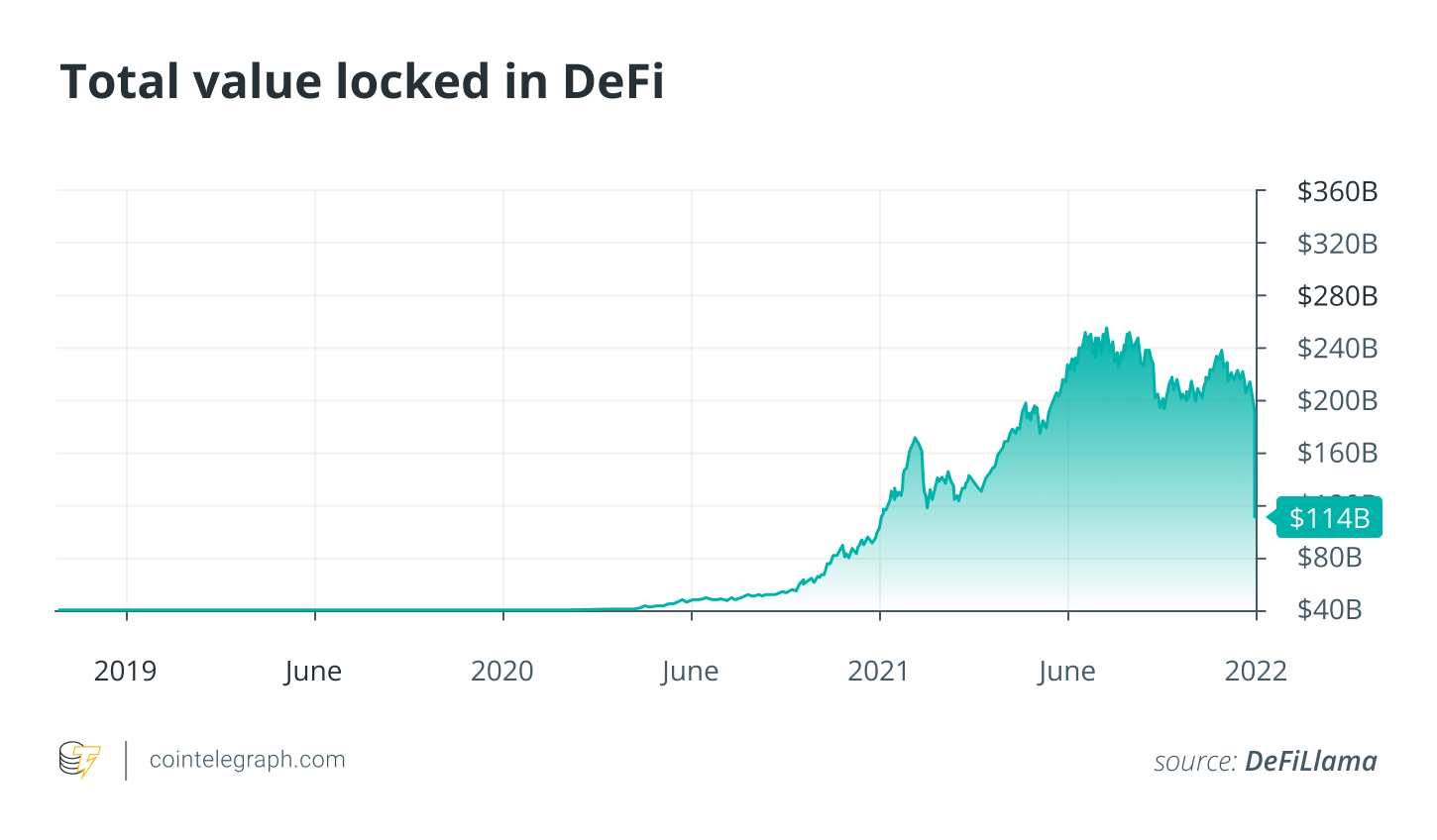

One can lend and borrow by varied platforms within the decentralized world, however one option to gauge the efficiency of a protocol and choose the proper one is by observing the full worth locked (TVL) on such platforms. TVL is a measure of the property staked in sensible contracts and is a vital indicator used to judge the adoption scale of DeFi protocols as the upper the TVL, the safer the protocol turns into.

Sensible contract platforms have change into a significant a part of the crypto ecosystem and make it simpler to borrow and lend because of the efficiencies supplied within the type of decrease transaction value, greater velocity of execution and quicker settlement time. Ethereum is used as a dominant sensible contract platform and can also be the primary blockchain to introduce sensible contracts. The TVL in DeFi protocols hasgrownby over 1,000% from simply $18 billion in January 2021 to over $110 billion in Could 2022.

Ethereum takes up greater than 50% of the TVL at $114 billion as per DefiLlama. Many DeFi lending and borrowing protocols are constructed on high of Ethereum because of the first-mover benefit. Nevertheless, different blockchains, comparable to Terra, Solana and Close to Protocol, have additionally elevated traction attributable to sure benefits over Ethereum comparable to decrease charges, greater scalability and extra interoperability.

Ethereum DeFi protocols comparable to Aave and Compound are a number of the most outstanding DeFi lending platforms. However one protocol that has grown considerably up to now yr is Anchor, which relies on the Terra blockchain. The highest DeFi lending protocols based mostly on TVL will be seen within the graph under.

The transparency supplied by DeFi platforms is unmatched by any conventional monetary establishment and in addition permits for permissionless entry, implying that any person with a crypto pockets can entry companies from any a part of the world.

Nonetheless, the potential for progress of the DeFi lending area is very large, and the usage of Web3 crypto wallets moreover ensures that DeFi contributors preserve a maintain over their property and have full management over their knowledge by advantage of the cryptographic safety supplied by blockchain structure.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a call.

The views, ideas and opinions expressed listed below are the creator’s alone and don’t essentially mirror or signify the views and opinions of Cointelegraph.

Neeraj Khandelwal is a co-founder of CoinDCX, an Indian crypto trade. Neeraj believes that crypto and blockchain can deliver a few revolution within the conventional finance area. He goals to construct merchandise that make crypto accessible to and straightforward for world audiences. His areas of experience lie within the crypto macro area, and he additionally has a eager eye for world crypto developments comparable to CBDCs and DeFi, amongst others. Neeraj holds a level in electrical engineering from the celebrated Indian Institute of Know-how Bombay.