Sept. 12 will go away a mark that may in all probability stick for fairly some time. Merchants on the Bitfinex alternate vastly diminished their leveraged bearish Bitcoin (BTC) bets and the absence of demand for shorts might have been attributable to the expectation of cool inflation knowledge.

Bears could have lacked confidence, however August’s U.S. Client Worth Index (CPI) got here in greater than market expectations and they look like on the best facet. The inflation index, which tracks a broad basket of products and providers, elevated 8.3% over the earlier yr. Extra importantly, the power costs element fell 5% in the identical interval however it was greater than offset by will increase in meals and shelter prices.

Quickly after the worse-than-expected macroeconomic knowledge was launched, U.S. fairness indices took a downturn, with the tech-heavy Nasdaq Composite Index futures sliding 3.6% in half-hour. Cryptocurrencies accompanied the worsening temper, and Bitcoin value dropped 5.7% in the identical interval, erasing features from the earlier 3 days.

Pinpointing the market downturn to a single inflationary metric could be naive. A Financial institution of America survey with world fund managers had 62% of respondents saying {that a} recession is probably going, which is the very best estimate since Could 2020. The analysis paper collected knowledge on the week of Sept. 8 and was led by strategist Michael Hartnett.

Apparently, as all of this takes place, Bitcoin margin merchants have by no means been so bullish, based on one metric.

Margin merchants flew away from bearish positions

Margin buying and selling permits traders to leverage their positions by borrowing stablecoins and utilizing the proceeds to purchase extra cryptocurrency. However, when these merchants borrow Bitcoin, they use the cash as collateral for shorts, which suggests they’re betting on a value lower.

That’s the reason some analysts monitor the overall lending quantities of Bitcoin and stablecoins to know whether or not traders are leaning bullish or bearish. Apparently, Bitfinex margin merchants entered their highest leverage lengthy/quick ratio on Sept. 12.

Bitfinex margin merchants are identified for creating place contracts of 20,000 BTC or greater in a really quick time, indicating the participation of whales and huge arbitrage desks.

Because the above chart signifies, on Sept. 12, the variety of BTC/USD lengthy margin contracts outpaced shorts by 86 occasions, at 104,000 BTC. For reference, the final time this indicator flipped above 75, and favored longs, was on Nov. 9, 2021. Sadly, for bulls, the end result benefited bears as Bitcoin nosedived 18% over the subsequent 10 days.

Derivatives merchants have been overly excited in November 2021

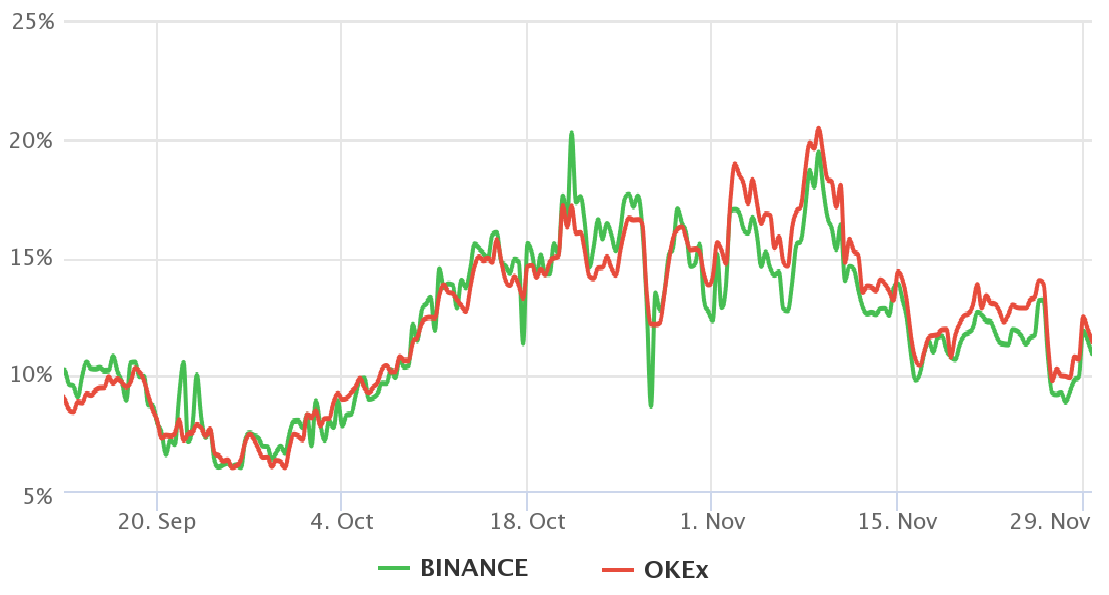

To grasp how bullish or bearish skilled merchants are positioned, one ought to analyze the futures foundation fee. That indicator is also referred to as the futures premium, and it measures the distinction between futures contracts and the present spot market at common exchanges.

The three-month futures sometimes commerce with a 5% to 10% annualized premium, which is deemed a chance value for arbitrage buying and selling. Discover how Bitcoin traders have been paying extreme premiums for longs (buys) throughout the rally in November 2021, the exact opposite of the present scenario.

On Sept. 12, the Bitcoin futures contracts have been buying and selling at a 1.2% premium versus common spot markets. Such a sub-2% stage has been the norm since Aug. 15, leaving no doubts concerning merchants’ lack of leverage shopping for exercise.

This week’s Ethereum Merge might be essentially the most vital shift in crypto’s historical past

Attainable causes of the margin lending ratio spike

One thing will need to have brought about short-margin merchants at Bitfinex to scale back their positions, particularly contemplating that the longs (bulls) remained flat throughout the 7 days resulting in Sept. 12. The primary possible trigger is liquidations, which means the sellers had inadequate margin as Bitcoin gained 19% between Sept. 6 and 12.

Different catalysts may need led to an uncommon imbalance between longs and shorts. As an illustration, traders might have shifted the collateral from Bitcoin margin trades to Ethereum, on the lookout for some leverage because the Merge approaches.

Lastly, bears might have determined to momentarily shut their margin positions because of the volatility surrounding the U.S. inflation knowledge. Whatever the rationale behind the transfer, there is no such thing as a cause to consider that the market all of the sudden turned extraordinarily optimistic because the futures markets’ premium paints a really completely different situation from November 2021.

Bears nonetheless have a glass-half-full studying as Bitfinex margin merchants have room so as to add leverage quick (promote) positions. In the meantime, bulls can have fun the obvious lack of curiosity in betting on costs beneath $20,000 from these whales.

The views and opinions expressed listed below are solely these of the author and don’t essentially mirror the views of Cointelegraph. Each funding and buying and selling transfer includes threat. It is best to conduct your personal analysis when making a choice.