A Bitcoin (BTC) on-chain indicator, which tracks the quantity of coin provide held by long-term holders (LTHs) in losses, is signaling {that a} market backside could possibly be shut.

Eerily correct Bitcoin backside pundit

As of Sept. 22, roughly 30% of Bitcoin’s LTHs had been dealing with losses as a result of BTC’s decline from $69,000 in November 2021 to around $19,000 now. That is about 3%–5% below the level that previously coincided with Bitcoin’s market bottoms.

For instance, in March 2020, Bitcoin price declined below $4,000 amid the COVID-19-led market crash, which happened when the amount of BTC supply held by LTH in loss climbed toward 35%, as shown below.

Similarly, Bitcoin’s December 2018 bottom of around $3,200 concurred alongside the LTH loss metric rising above 32%. In both cases, BTC/USD followed up by entering a long bullish cycle.

Hence, the number of LTHs in loss during a typical bear market tends to peak in the 30%–40% range. In other words, Bitcoin’s price still has room to drop — likely into the $10,000–$14,000 range —for “LTHs in loss” to reach the historic bottom zone.

Coupled with the LTH supply metric, which tracks the BTC supply held by long-term holders, it appears that these investors accumulate and hold during market downturns and distribute during BTC price uptrends, as illustrated below.

Therefore, the next bull market may begin when total supply held by LTHs begins to decline.

Bitcoin accumulation is strong

Meanwhile, the number of accumulation addresses has been increasing consistently during the current bear market, data shows.The metric tracks addresses which have “not less than two incoming non-dust transfers and have by no means spent funds.”

Curiously, that is completely different from the earlier bear cycles that noticed the variety of accumulation addresses drop or stay flat, as proven within the chart above, suggesting that “hodlers” are unfazed by present worth ranges.

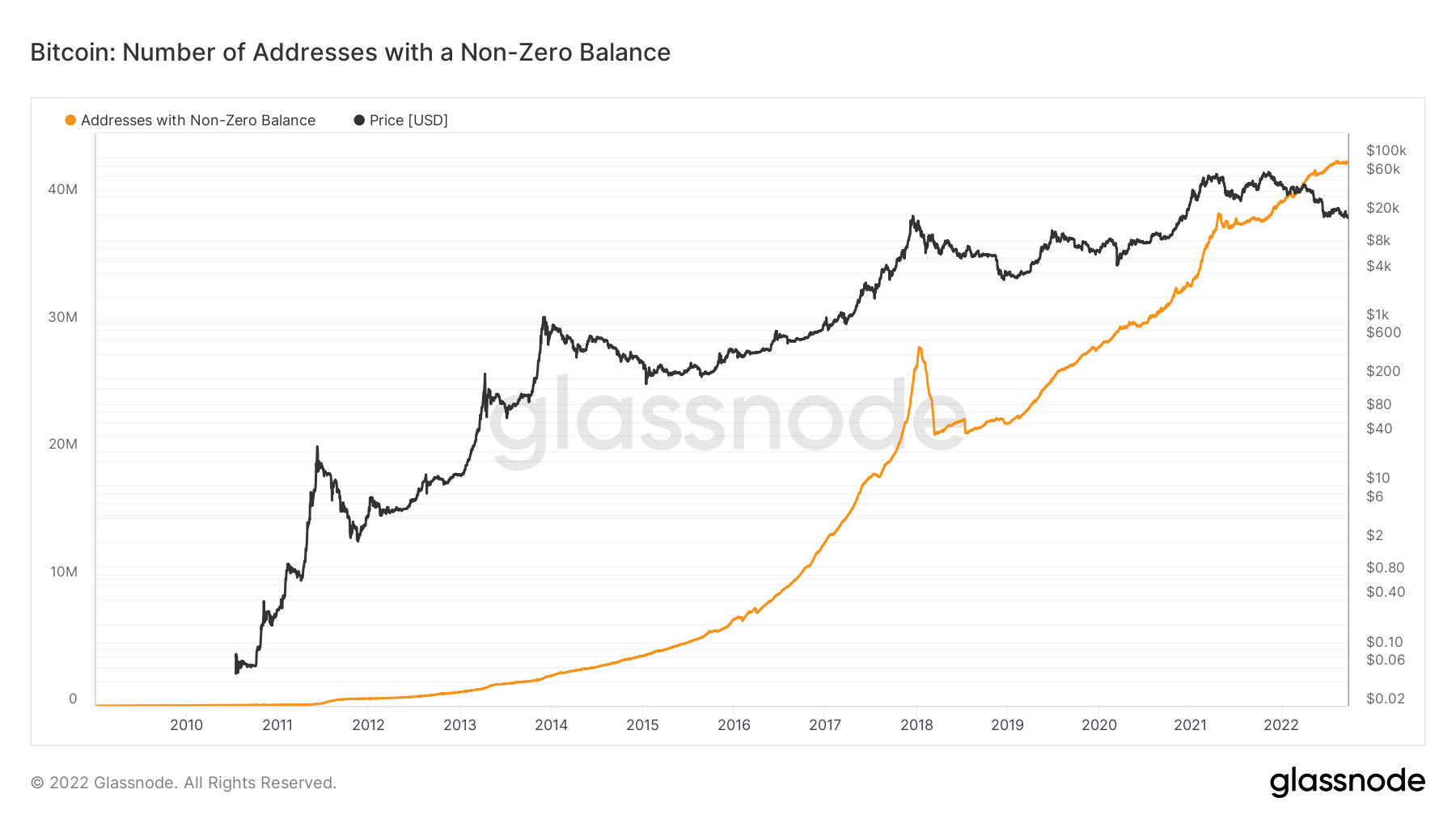

As well as, the variety of addresses with a non-zero steadiness stands round 42.7 million versus 39.6 million in the beginning of this 12 months, displaying constant person development in a bear market.

BTC worth technicals trace at extra draw back

Bitcoin is nonetheless struggling to reclaim $20,000 as help in the next rate of interest surroundings. Its correlation with U.S. equities additionally hints at extra downsidein 2022.

Bitcoin analysts give 3 the explanation why BTC worth under $20K could also be a ‘bear lure’

From a technical perspective, Bitcoin may drop additional towards $14,000in 2022 if its cup-and-handle breakdown pans out, as proven under.

Such a transfer ought to push the aforementioned “LTH in loss” metric towards the 32%–35% capitulation area, which may finally coincide with the underside within the present bear market.

The views and opinions expressed listed below are solely these of the writer and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer includes danger, you must conduct your personal analysis when making a call.