Bitcoin (BTC) value stays pinned under $22,000 because the lingering affect of the Aug. 19 sell-off at $25,200 continues to be felt throughout the market.

In accordance with analysts from on-chain monitoring useful resource Glassnode, BTC’s faucet on the $25,000 degree was adopted by “distribution” as profit-takers and short-term holders offered as value encountered a trendline resistance following a 23 consecutive day uptrend that noticed BTC buying and selling above it’s realized value ($21,700).

The agency additionally famous that the “complete inflows and outflows to all exchanges” metric reveals change flows at multi-year lows and again to “late-2020 ranges,” which displays a “normal lack of speculative curiosity.”

Shares and crypto clearly danger off till we hear the Fed views popping out of Jackson Gap this week/finish. $BTC value continues to vary, however appears to be like a bit “gentle.” pic.twitter.com/jpVjG2jslh

— Massive Smokey (@big_smokey1) August 23, 2022

From a higher-time body perspective, Bitcoin’s present value motion is solely a continuation of its close to 3-month lengthy chop within the $18,500 to $22,000 vary, however the actual damper on sentiment are persistent non-crypto associated issues in the US and world economic system.

On August 25 the Jackson Gap Financial Symposium begins and from this the general public will study extra concerning the Federal Reserve’s perspective on the U.S. economic system, its plans for future rate of interest hikes, whether or not or not the inflation goal stays at 2% and if the Fed thinks the united statesand world economic system are in recession. Anticipation over the symposium has clearly made buyers skittish and these frayed nerves are seen within the S&P 500, DJI and crypto markets this week.

In accordance with Serhii Zhdanov, CEO of EXMO cryptocurrency change:

“It seems there is no such thing as a single driver for the latest decline. The worldwide crises proceed, and it isn’t sure the place the underside is. Inflation is forcing individuals to do away with their investments to get money to cowl every day bills. In lots of international locations the entire quantity of bank card debt is breaking to new file highs. Current knowledge reveals that Covid isn’t gone and geopolitical pressure additional provides gasoline to world markets’ decline.”

Ether marches to the beat of its personal drum

Ether (ETH), then again, seems to be exhibiting some upside promise from a technical evaluation point-of-view. Final week, the asset corrected alongside BTC and endured just a few blows associated to centralization fears after the OFAC sanctioned Twister Money and the crypto neighborhood grew fearful over potential outcomes of the proof-of-stake transition making the community (and its largest ETH stakers) prone to censorship and regulation.

Typically, the bullish “merge” narrative stays in play and the massive cup and deal with sample seen on Ether’s every day timeframe, plus the bounce off the $1,500 degree are sufficient to assist merchants’ desires of ETH value rising into the $2,500 to $2,900 vary.

Ether appears to be like equally juicy in its ETH/BTC pair which bounced off assist within the 0.073 BTC vary.

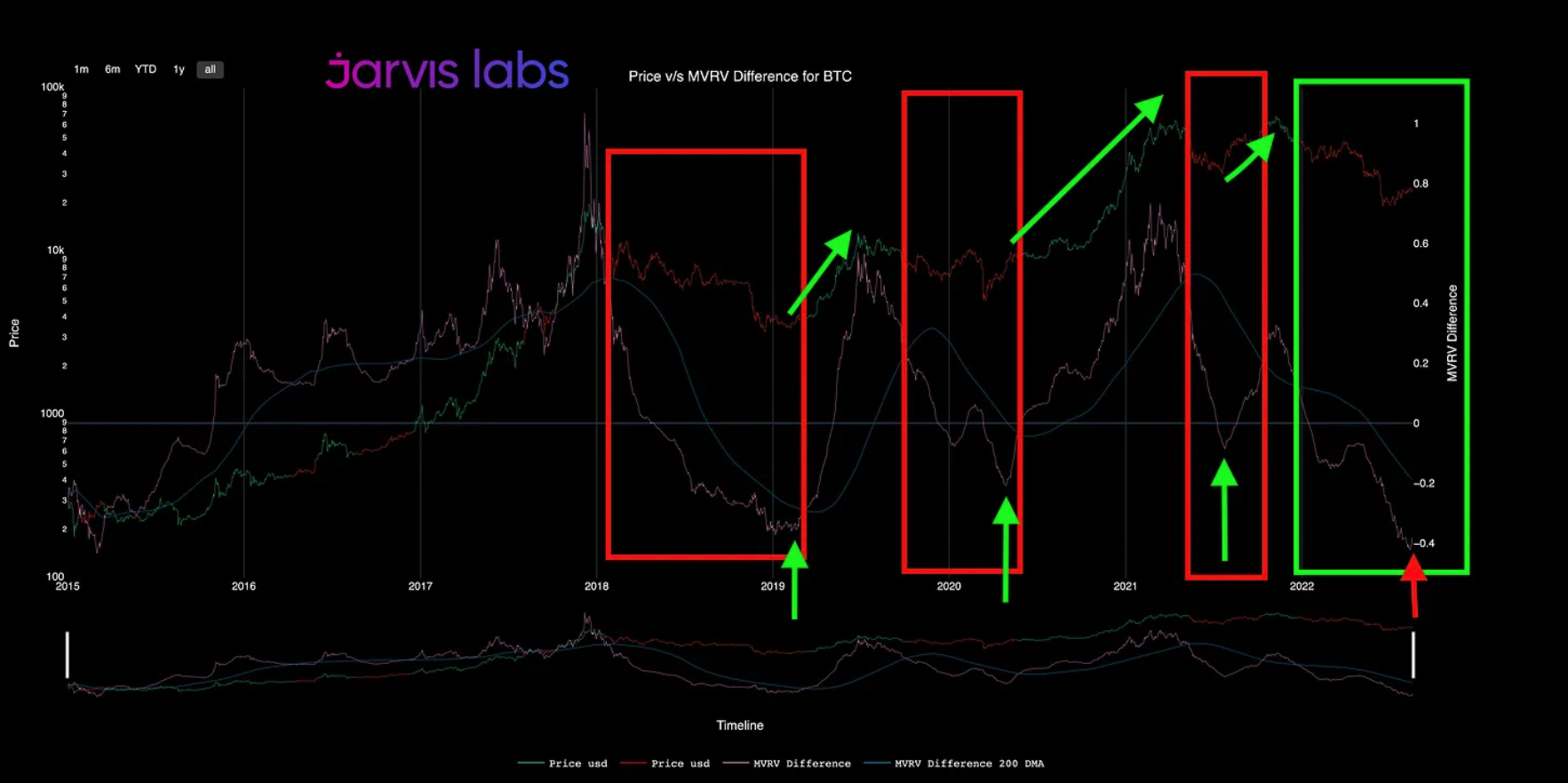

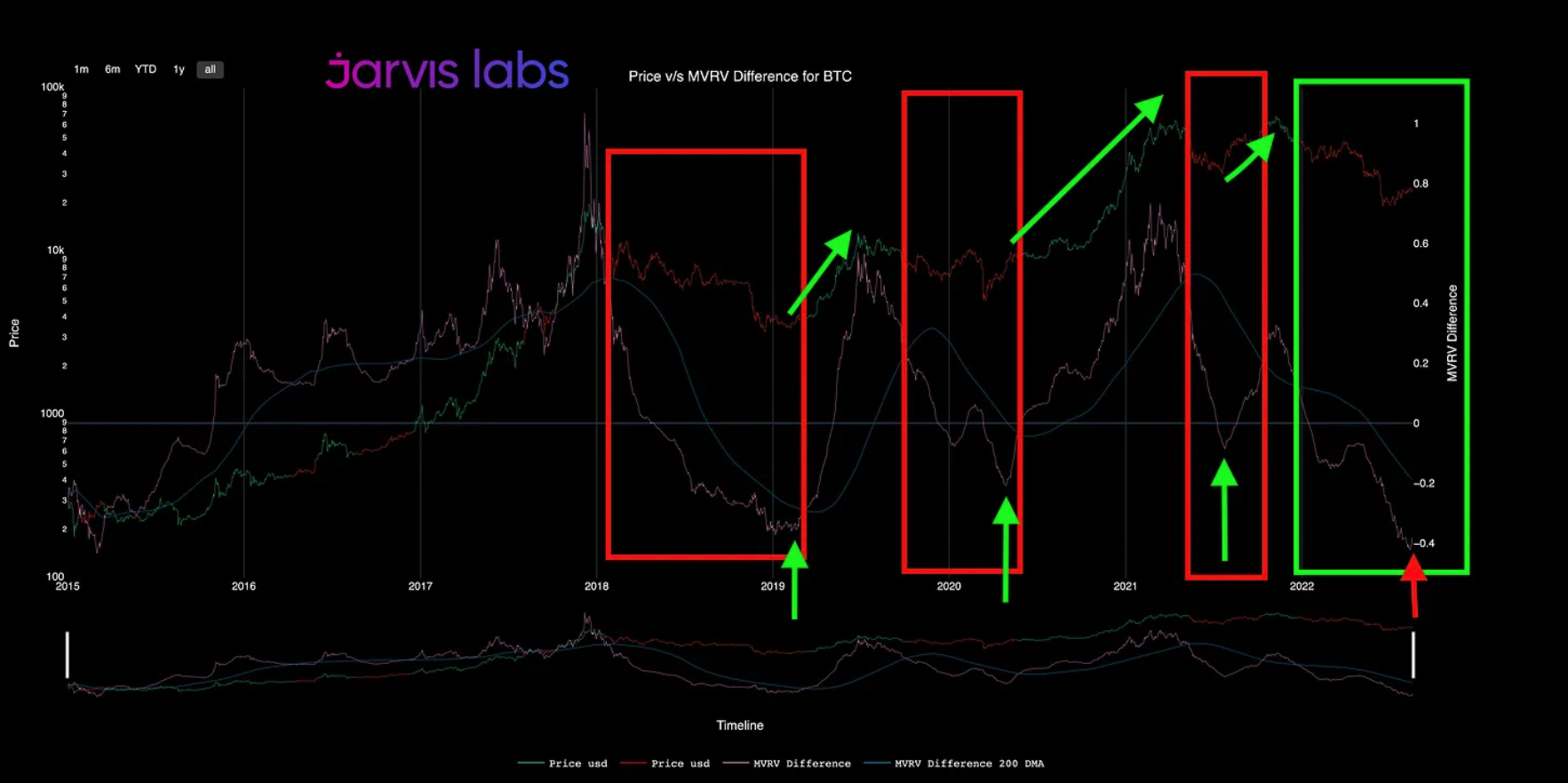

MVRV on-chain knowledge factors to undervalued Bitcoin

As @big_smokey1 talked about “shares and crypto [are] clearly danger off” with Jackson Gap upcoming and when it comes to value motion, that is more likely to manifest as continued resistance at Bitcoin’s long-term descending trendline till a enough catalyst to impress a development change emerges.

What crashed the crypto reduction rally? Discover out now on The Market Report

In the intervening time, Bitcoin’s short-term value prospects are lower than optimistic, however Jarvis Labs resident analyst “JJ” pinpointed a key on-chain metric which suggests BTC is buying and selling in a generational purchase zone.

In accordance with JJ, Bitcoin’s MVRV (Market Capitalization versus Realized Capitalization) indicator is printing a studying that’s “extraordinarily low.”

Does this imply that buyers ought to exit and put each final penny into BTC? Most likely not, however because the MVRV chart above reveals, greenback price averaging into BTC when its on-chain and technical metrics hit excessive lows has confirmed to be a worthwhile technique within the final three bull markets.

The views and opinions expressed listed here are solely these of the creator and don’t essentially replicate the views of Cointelegraph.com. Each funding and buying and selling transfer includes danger, you must conduct your personal analysis when making a choice.