The value motion for Bitcoin (BTC) continues to tantalize buyers and as soon as once more, issues over the state of the worldwide financial system and rising inflation have prompted warnings that the Fed’s upcoming rate of interest hikes might do extra injury then good to the state of the market.

Information from Cointelegraph Markets Professional and TradingView reveals that the worth of BTC has hovered close to the $43,000 assist stage in buying and selling on Feb. 11 after rallying 20% from the $37,000 leve over the previous week.

Right here’s a take a look at what analysts anticipate subsequent for BTC and the broader cryptocurrency market.

“Anticipating a transfer to $40,000”

Perception into the bullish and bearish situations associated to Bitcoin worth was supplied by crypto dealer and pseudonymous Twitter analyst ‘Crypto_Ed_NL’, who posted the next chart outlining two doable BTC worth trajectories.

Crypto_Ed_NL mentioned,

“Checking my newest chart with the present scenario. Nothing modified. Anticipating a transfer in direction of $40,000. Bullish state of affairs signifies a bounce to $48,000. Bearish is available in play once we break $40,000.”

A confluence of resistance ranges for BTC

Bitcoin now finds itself buying and selling in an more and more tighter rage at these present ranges largely as a consequence of “the sharp $12,000 transfer off the lows” of Feb. 4, in keeping with a current report from Delphi Digital, which famous that BTC is now “heading into resistance on a number of timeframes.”

As the worth motion for BTC heads towards a confluence of each day, weekly and month-to-month resistance, Delphi Digital analysts recommend that “market contributors of all types can be this as a possible worth ceiling” and that it represents “a logical place to anticipate profit-taking/threat discount exercise as a result of confluence of resistance zones and the pace and magnitude of the transfer off current lows.”

As for the important thing areas to regulate shifting ahead, Delphi Digital highlighted a big quantity of assist for BTC within the $40,000 to $41,000 vary with the following stage of assist beneath that at $38,500.

With regards to the opportunity of a transfer increased for BTC, Delphi Digital listed the zone from $46,000 to $48,000 as a heavy resistance space.

The report famous that,

“That is the each day, weekly and month-to-month provide zones that may seemingly be a heavy stage of resistance. Above this stage and we seemingly see a squeeze in direction of $50,000.”

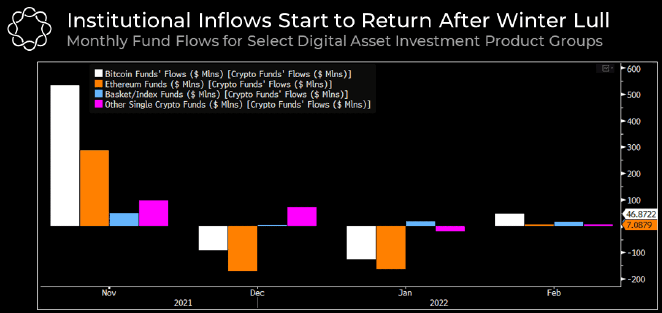

On a optimistic be aware, Delphi Digital additionally highlighted the current uptick in institutional flows over the previous couple of weeks “because the market began to stage a comeback.”

In line with Delphi Digital, Grayscale is the most important participant within the institutional sport with “roughly 65% of Institutional AUM,” however there are indicators rising that sentiment is starting to shift.

Delphi Digital mentioned,

“Excluding BTC and ETH, Binance Coin (BNB), and BNB-based merchandise, have continued to draw probably the most AUM, however institutional sentiment is beginning to favor various names like SOL.”

Bitcoin caught in a good vary as BTC worth shifting averages put together key bullish cross

Bulls might exploit this traditional buying and selling sample

A last bullish perspective for BTC shifting ahead was supplied by crypto analyst and pseudonymous Twitter consumer ‘IamCryptoWolf’, who posted the next chart outlining one doable Bitcoin worth trajectory.

IamCryptoWolf mentioned,

“Everybody calling for $46,000, what if $50K –> $46K –> $60K, printing an inverse head and shoulders?”

The general cryptocurrency market cap now stands at $1.97 trillion and Bitcoin’s dominance price is 41.9%.

The views and opinions expressed listed below are solely these of the creator and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer includes threat, you need to conduct your individual analysis when making a choice.