Bitcoin (BTC) trended towards a $40,000 retest on Feb. 12 as BTC value motion bore out analysts’ predictions.

Dealer hopes to keep away from ‘ugly’ weekly shut

Information from Cointelegraph Markets Professional and TradingViewconfirmed BTC/USD reaching native lows of $41,741 on Bitstamp Saturday earlier than a rebound over $42,000.

An about-turn had ended the pair’s advance after U.S. CPI information hit, and calls quickly emerged for a return to $40,000 and even decrease to see how steely bulls’ resolve actually was.

For Cointelegraph contributor Michaël van de Poppe, the outcomes have been nonetheless inconclusive, however warning was undoubtedly wanted going ahead on short-timeframe trades.

“Bitcoin wanting on the identical resistance nonetheless,” he summarized alongside a chart displaying potential help and resistance targets.

“Weekly order block rejecting in a harsh method. Weekly candle begins to look ugly + a number of ranges of concern throughout the marketplace for coming weeks. Remaining flat at this stage.”

Others in the meantime referred to as time on the potential scope of Bitcoin’s longer-term draw back.

“For these ready for sub 30k $BTC, might the crypto gods be with you as a result of the percentages will not be,” well-liked Twitter commentator Credible Crypto suggested.

For these ready for sub 30k $BTC, might the crypto gods be with you as a result of the percentages will not be. https://t.co/LJPDoa4KCx

— Credible Crypto (@CredibleCrypto) February 12, 2022

Even at present ranges, Bitcoin’s weekly shut was set to be virtually similar to the final, thus preserving nearly all of the prior positive factors that had taken it out of the $30,000 zone.

Straight again to “concern”

The late drawdown this week was nonetheless greater than convincing sufficient for crypto market sentiment to take a contemporary hit.

Bitcoin caught in a decent vary as BTC value transferring averages put together key bullish cross

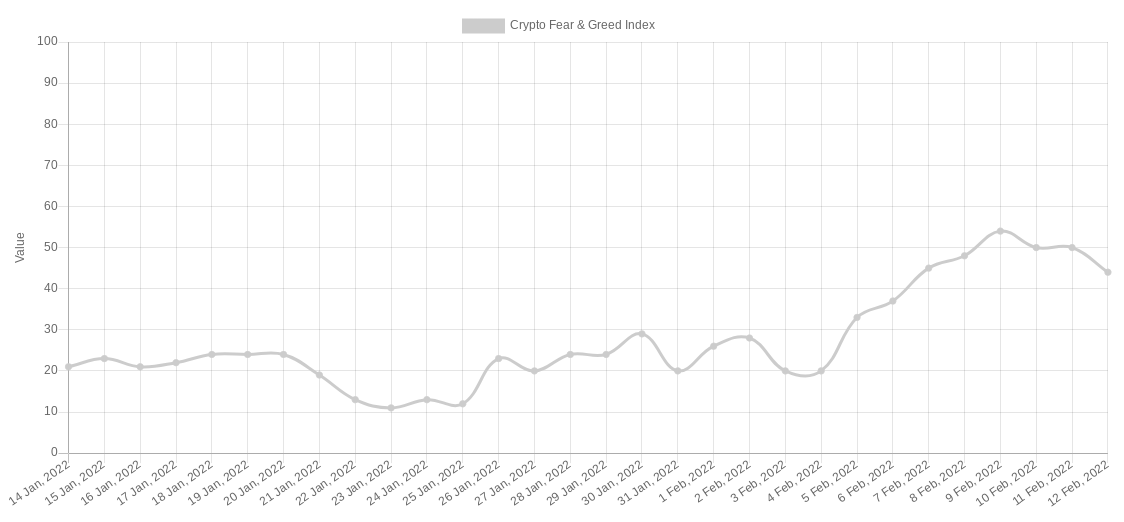

Based on the Crypto Fear & Greed Index, three days of “impartial” territory was sufficient earlier than the return of “concern” as the primary drive at play amongst merchants.

On Saturday, the Index measured 44/100, having reached 54/100 Wednesday.

Discussing January’s weeks-long journey into the underside “excessive concern” zone, buying and selling suite Decentrader argued {that a} sentiment reset had probably already come based mostly on historic patterns.

“Such prolonged intervals of utmost concern give a sign that common market members could be caught offside. We noticed that play out with the quick transfer to the upside that $BTC has proven over the previous two weeks,” analysts wrote in a market update launched Friday.