Bitcoin (BTC) worth continues to sell-off and the knock-on impact is an excellent sharper correction in altcoins and DeFi tokens. On the time of writing, BTC worth has sank to itslowest degree in 6 monthsand most analysts usually are not optimistic about a right away flip round.

Knowledge from Cointelegraph Markets Professional and TradingView exhibits {that a} wave of promoting that started late within the day on Jan. 20 continued into noon on Friday when BTC hit a low of $36,600.

Right here’s a check-in with what analysts must say in regards to the present downturn and what could also be in retailer for the approaching weeks.

Merchants anticipate consolidation between $38,000 and $43,000

The sudden worth drop in BTC has many crypto merchants predicting numerous dire outcomes alongside the traces of an prolonged bear market. Others like impartial market analyst ‘Rekt Capital’, usually are not so fast to leap the gun and declare that every one is misplaced.

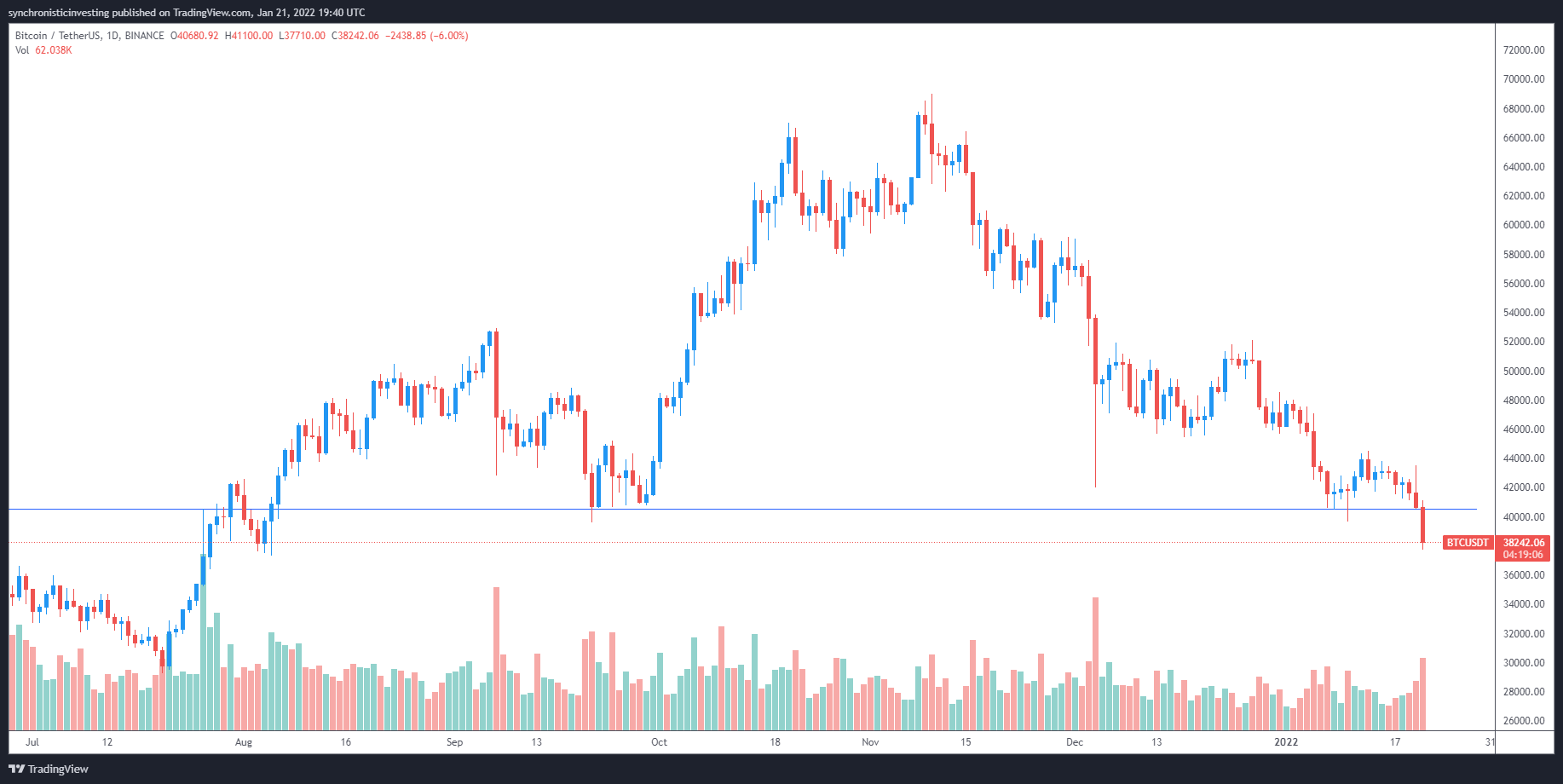

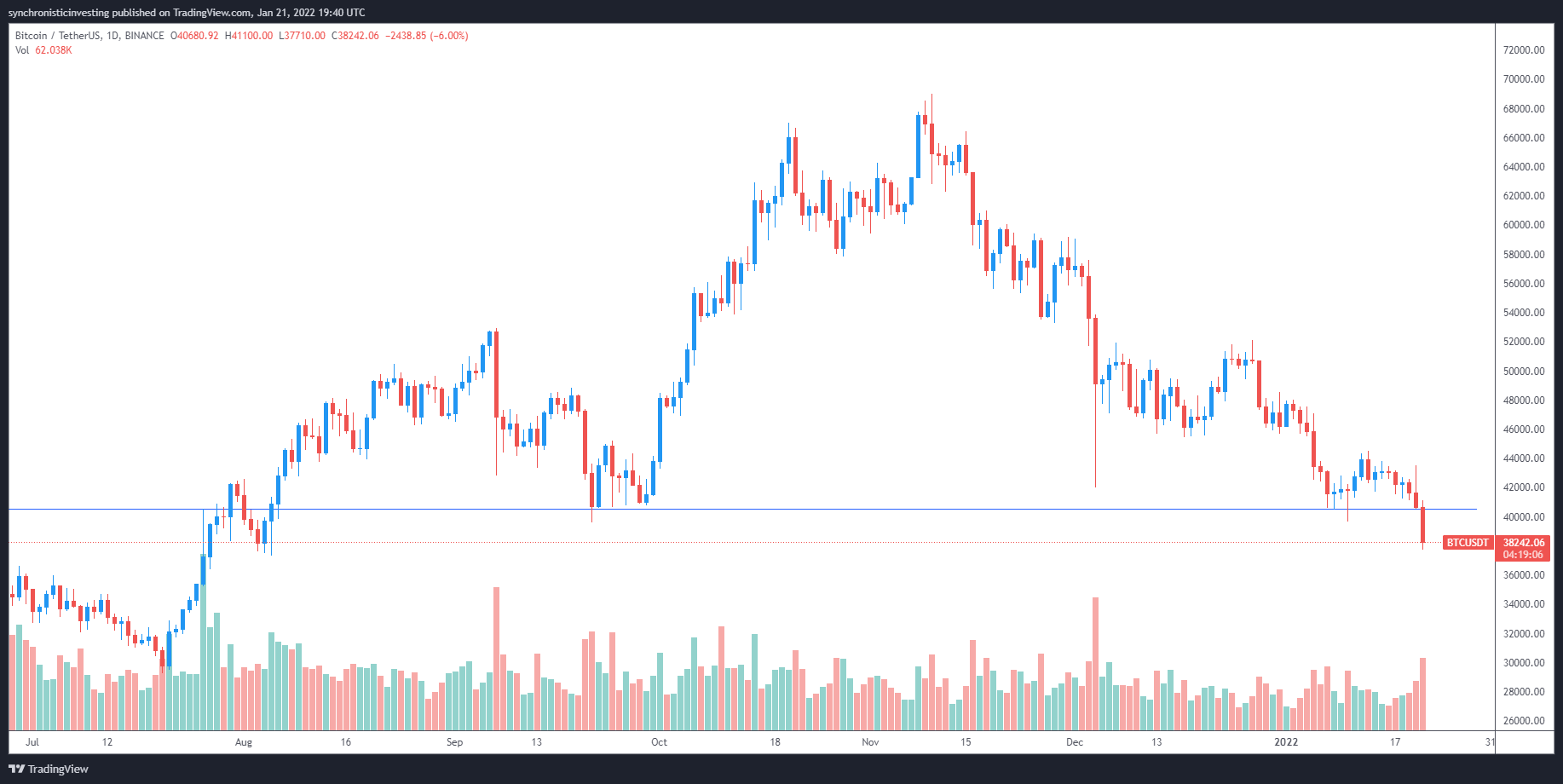

As proven within the following chart posted by Rekt Capital, “the latest BTC rejection implies that BTC is now residing on the decrease area of its present $38,000-$43,100 vary.”

In keeping with Rekt Capital, “Bitcoin is simply consolidating contained in the $38,000-$43,100 vary,” however wants to carry this help degree to keep away from dropping down right into a decrease consolidation vary.

Rekt Capital mentioned,

“Technically, the $38,000 help space is what separates BTC from coming into the $28,000-$38,000 consolidation vary. Bitcoin final consolidated in mentioned vary in Q1 and Q2 of 2021.”

Head and shoulders sample confirmed

Evaluation of the BTC worth motion from a purely technical viewpoint was touched on by David Lifchitz, managing associate and chief funding officer at ExoAlpha, who identified that the “large head and shoulders sample for BTC is now accomplished with the neckline damaged with BTC at $38,300.”

From a theoretical standpoint, Lifchitz famous that this sample predicts a doable drawdown as little as $20,000, however he said that the “fall has typically been lower than that” and prompt that “the $31,000 area may positively be in sight.”

From a elementary viewpoint, Lifchitz famous a number of components which are creating headwinds for BTC, together with tightening from the U.S. Federal Reserve, chatter from the EU regulators trying to ban proof-of-work mining, profit-taking from late 2021 and the continued uncertainty in regards to the financial future because it pertains to the Covid pandemic.

Lifchitz mentioned,

“Due to this fact for Bitcoin, a transfer all the way down to the low-mid $30,000 may very well be positively within the playing cards quickly earlier than actual dip-buyers present up.”

Merchants look to scoop up BTC at $30,000

A take a look at how merchants have responded to this drawdown as in comparison with the pullback in June of 2021 was offered by analyst and Cointelegraph contributor Michaël van de Poppe, who posted the next chart highlighting the key help zones for every interval of weak point.

van de Poppe mentioned,

“Again in June → Individuals are ready for $23,000 to $25,000 to purchase. Proper now → Individuals are ready for $30,000 to purchase. Related pretend breakout on the upside to nuke afterward into help.”

An identical viewpoint was provided by dealer and pseudonymous Twitter person ‘Fomocap’, who posted the next chart outlining how BTC may carry out within the days forward.

Fomocap mentioned,

“Reduction bounce to $44,000 – $42,000 retest, if rejection then $35,000 – $33,000. What do you assume?”

Crypto Twitter responds to Bitcoin dump: ‘Okay cool’

Bulls want an in depth above $39,600

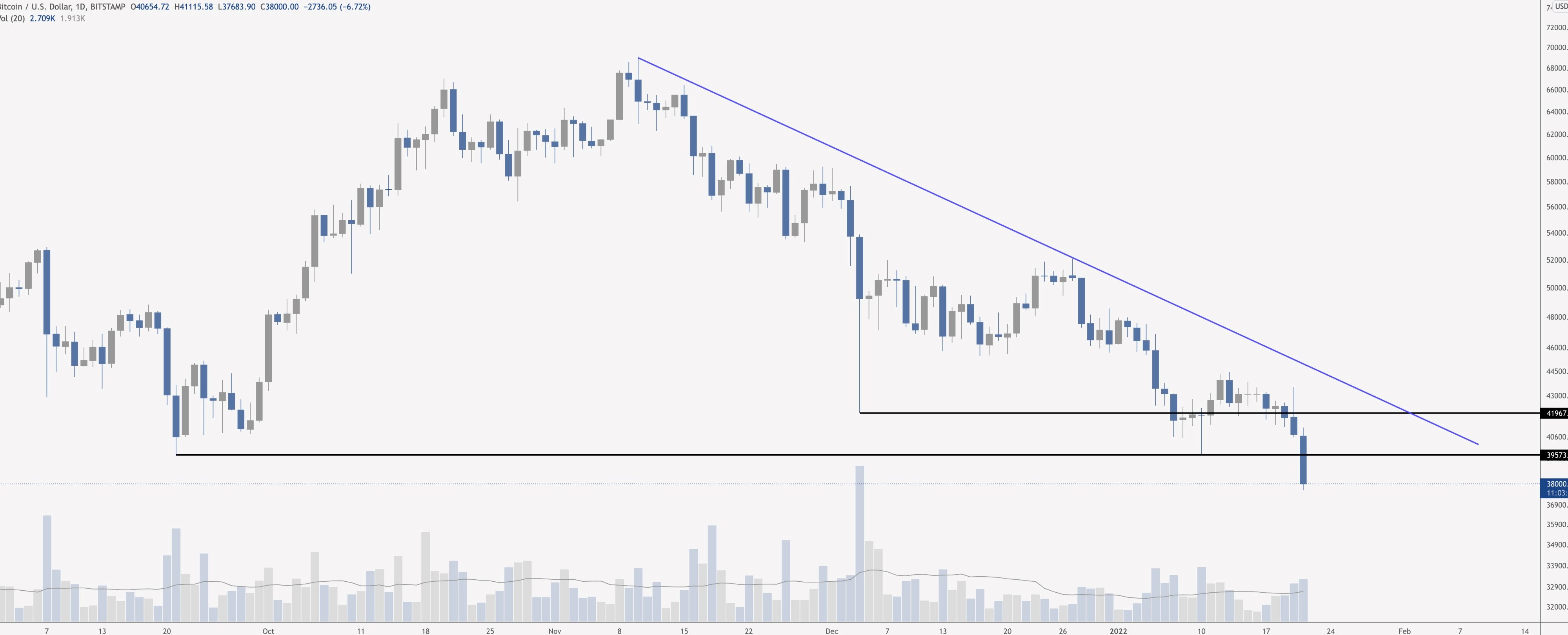

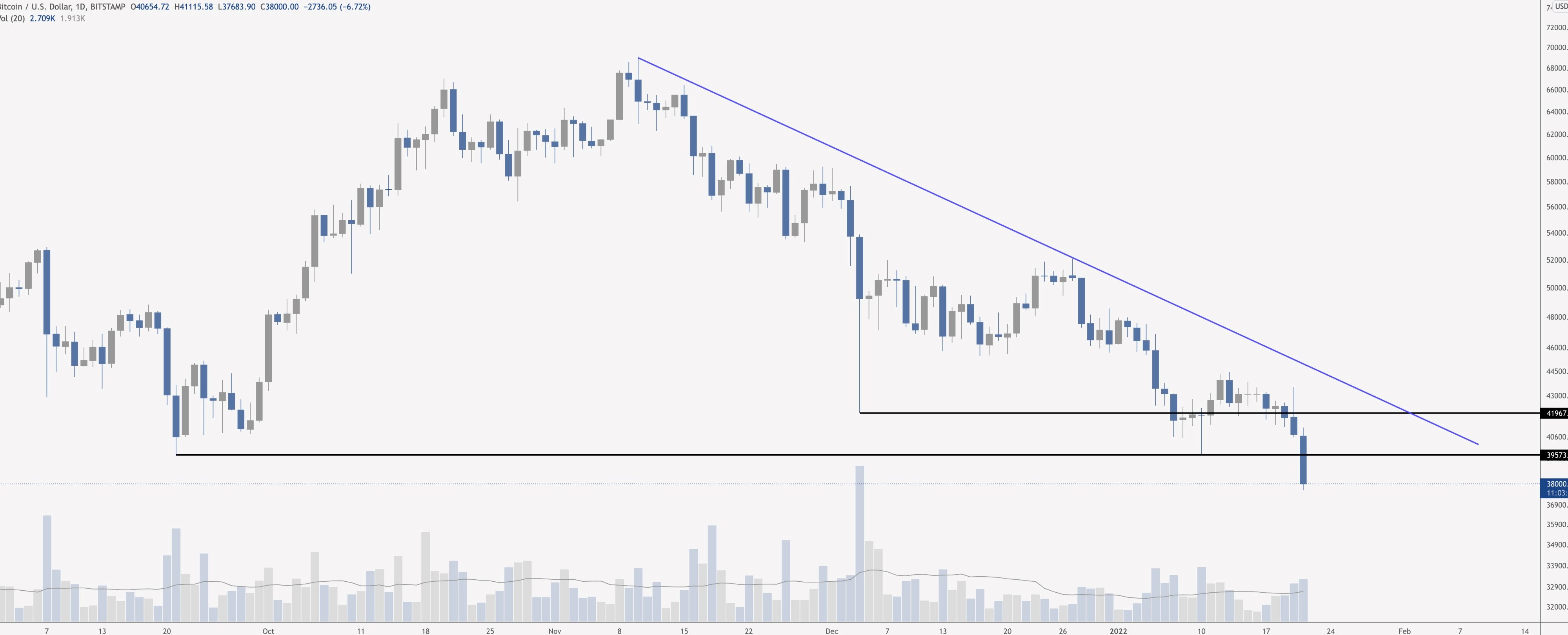

A ultimate little bit of perception into was provided by crypto dealer Scott Melker, who posted the next chart exhibiting the value breakdown beneath a key degree that have to be recovered.

Melker mentioned,

“Bulls on the lookout for a Hail Mary shut above $39,600 on the each day. A detailed beneath (particularly on weekly) is a break in market construction, decrease low and many others. Bears exhibiting no mercy.”

The general cryptocurrency market cap now stands at $1.801 trillion and Bitcoin’s dominance price is 40.4%.

The views and opinions expressed listed here are solely these of the writer and don’t essentially replicate the views of Cointelegraph.com. Each funding and buying and selling transfer includes threat, it is best to conduct your individual analysis when making a choice.