Bitcoin (BTC) worth initially bounced from its current low at $29,000 however the total market sentiment after a 25% worth drop in 5 days remains to be largely detrimental. Presently, the crypto “Worry and Greed Index,” which uses volatility, quantity, social metrics, Bitcoin dominance and Google developments knowledge, has plunged to its lowest degree since March 2020 and in the mean time, there seems to be little defending the market towards additional draw back.

Regulation continues to crush the markets

Regulation remains to be the principle risk weighing on markets and it is clear that traders are taking a risk-off method to excessive volatility property. Earlier this week, throughout a listening to of the Senate Banking Committee,United States Secretary of the Treasury Janet Yellencalled for a regulatory framework on stablecoins and particularly addressed the TerraUSD (UST) stablecoinplunging beneath $0.70.

Moreover, the UK launched two payments aimed toward addressin crypto regulation on Could 10. The Monetary Companies and Markets Invoice and the Financial Crime and Company Transparency Invoice purpose to strengthen the nation’s monetary companies business, together with supporting “the protected adoption of cryptocurrencies.”

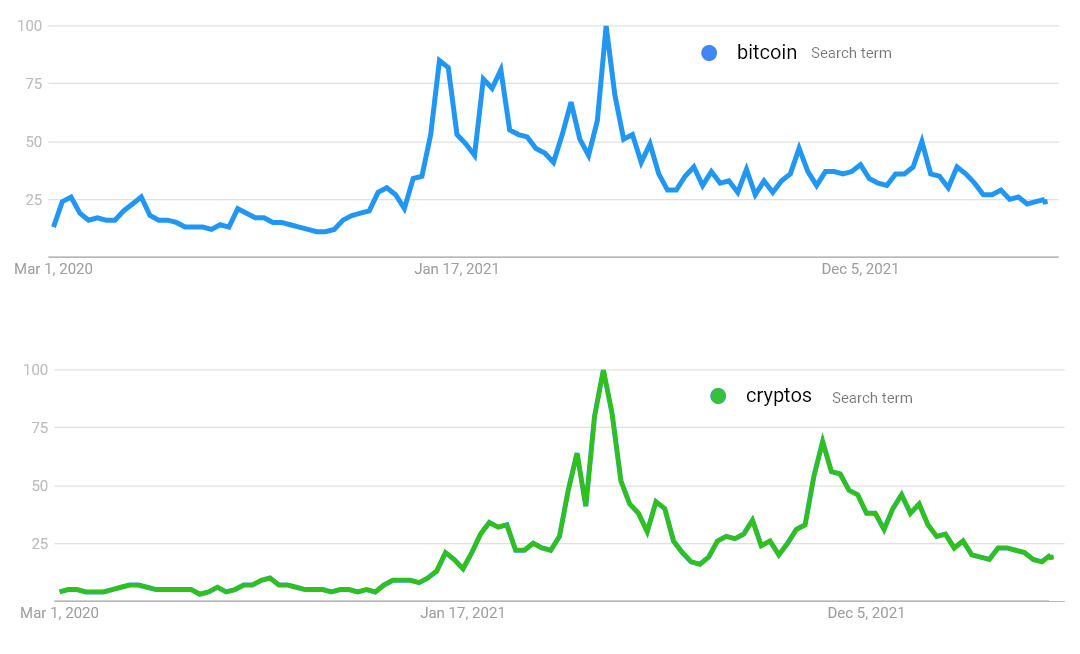

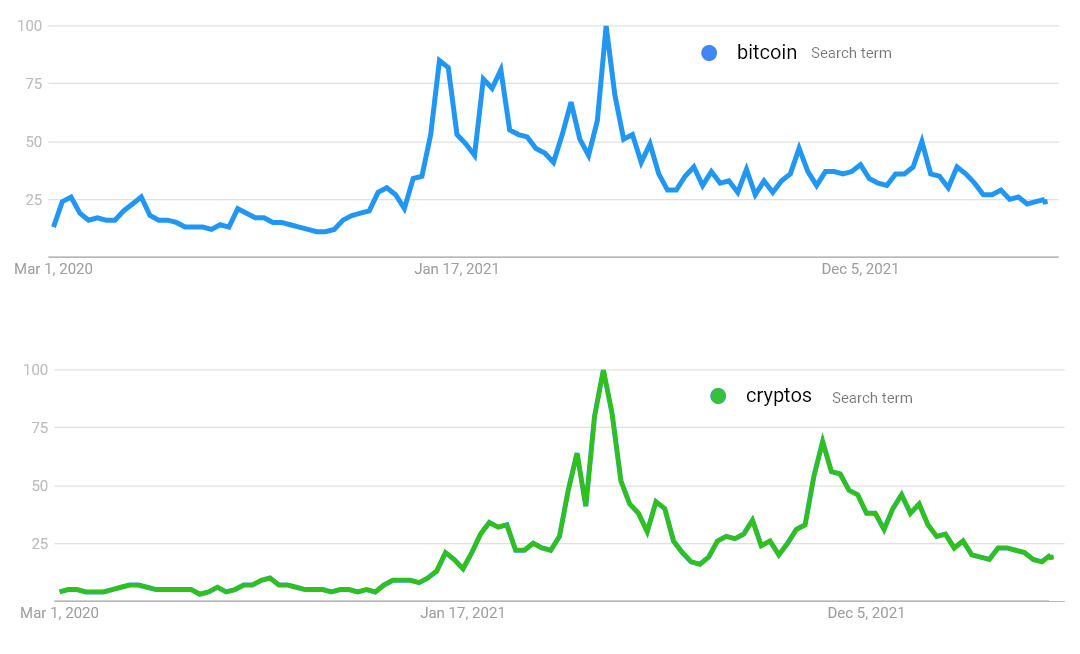

In the meantime, searches for “Bitcoin” and “crypto” on Google are nearing their lowest ranges in 17 months.

This indicator may partially clarify why Bitcoin is 56% beneath its $69,000 all-time excessive as a result of the general public curiosity is low however let’s check out how skilled merchants are positioned in derivatives markets.

Lengthy-to-short knowledge confirms an absence of consumers’ demand

The highest merchants’ long-to-short web ratio analyzes the positions on the spot, perpetual and futures contracts. From an evaluation standpoint, it offers a greater understanding on whether or not skilled merchants are bullish or bearish.

There are occasional methodological discrepancies between totally different exchanges, so viewers ought to monitor modifications as a substitute of absolute figures.

In accordance with the long-to-short indicator, Bitcoin might need jumped 4% for the reason that $29,000 low on Could 11, however skilled merchants didn’t enhance their bullish bets. As an illustration, OKX’s prime merchants’ ratio decreased from 1.20 to the present 1.00 degree.

Furthermore, Binance knowledge reveals these merchants secure close to 1.10, and an identical pattern occurred at Huobi as the highest merchants’ long-to-short ratio stood at 0.97. Information reveals no demand for leverage buys amongst skilled traders regardless of the 5% worth restoration.

CME futures merchants are not bearish

To additional show that the crypto market construction has deteriorated, merchants ought to analyze the CME’s Bitcoin futures contracts premium. The metric compares longer-term futures contracts and the normal spot market worth.

These fixed-calendar contracts normally commerce at a slight premium, indicating that sellers request extra money to withhold settlement for longer. Consequently, the one-month futures ought to commerce at a 0.5% to 1% premium in wholesome markets, a state of affairs often called contango.

Every time that indicator fades or turns detrimental (backwardation), it’s an alarming pink flag as a result of it signifies that bearish sentiment is current.

The chart above reveals how the indicator entered backwardation on Could 10 and the transfer marks the bottom studying in two months at a detrimental 0.4% premium.

Information reveals that institutional merchants are beneath the “impartial” threshold measured by the futures’ foundation and this factors to the formation of a bearish market construction.

Moreover, the highest merchants’ long-to-short knowledge reveals an absence of urge for food regardless of the short 4% worth restoration from the $29,000 degree and the truth that BTC worth now trades close to the identical degree can be regarding. Except the derivatives metrics present some enchancment, the chances of additional worth correction stay excessive.

The views and opinions expressed listed here are solely these of the author and don’t essentially mirror the views of Cointelegraph. Each funding and buying and selling transfer entails threat. You need to conduct your personal analysis when making a choice.