Bitcoin (BTC) underwent a weak rebound on Sept. 21, and the U.S. greenback jumped to a brand new yearly excessive as buyers await Sept. 21’s Federal Open Market Committee’s rate of interest resolution.

BTC worth holds $19K forward of Fed resolution

BTC’s worth has managed to cling on to $19,000 with a modest every day achieve of 1.33% . In the meantime, the U.S. greenback index (DXY), which measures the dollar’s power versus a pool of high foreign currency, rose to 110.86, the very best degree in 20 years.

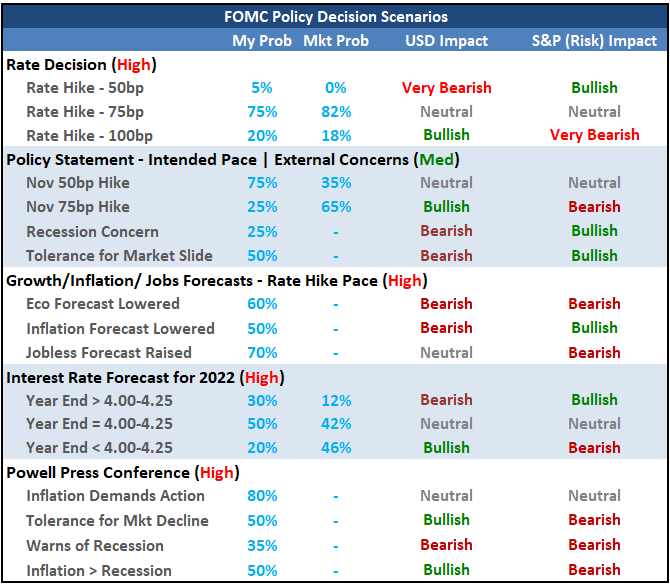

FOMC charge hike eventualities

The Federal Reserve is poised to debate how far it might elevate its benchmark lending charges to curb report inflation. Curiously, the market expects the U.S. central financial institution to hike charges by 75 or 100 foundation factors (bps).

The ramification of upper rates of interest will probably lead to alower urge for food for riskier property like shares and cryptocurrencies. Conversely, the U.S. greenback will function the go-to protected haven for buyers escaping risk-on property.

“There appears no cause for the Fed to melt the hawkishness proven on the current Jackson Gap symposium, and a [0.75 percentage point] ‘hawkish hike’ ought to preserve the greenback close to its highs of the 12 months,” analysts at ING told the Monetary Instances.

Impartial market analyst PostyXBT argues {that a} 100 bps charge can “nuke” Bitcoin under its present technical assist of $18,800. He additionally means that BTC has a superb likelihood of restoration if the speed hike seems to be decrease than anticipated, or 50 bps.

$BTC 1D

As us FOMC specialists would know, right now is a giant day!

100bps probably nukes assist for good?

50bps probably pumps and offers bulls some respiration room?Going to be a really attention-grabbing every day shut https://t.co/C5ClM436N6 pic.twitter.com/mJP7qpGEv1

— Posty (@PostyXBT) September 21, 2022

These speculations echo common charge hike expectations.John Kicklighter, the chief strategist at DailyFX, notes {that a} 50 bps charge hike could be bullish for the U.S. benchmark inventory market index.

Nonetheless, a 100 bps charge hike could be extraordinarily bearish for the S&P 500. This might be equally problematic for Bitcoin, whose correlation with stockshas been persistently constructive since December 2021.

Polls count on a 75 bps charge hike

The U.S. financial system suffered two back-to-back quarters of unfavorable progress. Furthermore, its manufacturing PMI pointed to the slowest progress in manufacturing unit exercise since July 2020. In the meantime, thetwo-year U.S.Treasury returns have crossed above the 10-year U.S. Treasury returns, plotting a yield curve.

What’s subsequent for Bitcoin and the crypto market now that the Ethereum Merge is over?

These metrics elevate the alarm about an impending recession. However offsetting these are unemployment knowledge at its report low and housing starter charges nonetheless above their hazard zone of $1.35 million, in accordance todata presented by Charles Edwards, founding father of Capriole Investments.

Usually, recession warnings immediate the Fed to pivot. In different phrases, to cut back or pause mountaineering charges. However Edwards notes that the central financial institution won’t pivot for the reason that U.S. financial system is technically not in recession.

“Till main considerations of recession present up, till it hurts the place it counts — employment — there isn’t any cause to count on an pressing change in Fed coverage right here,” he wrote, including:

“So it’s enterprise as typical till we’ve got proof that inflation is below management.”

Most economists, or 44 of the 72 polled by Reuters, additionally predictthat Fed would elevate charges by 75 bps of their September assembly. Subsequently, Bitcoin might keep away from a deeper correction if it maintains its correlation with the S&P 500, primarily based onKicklighter’s outlook.

Bitcoin to $14K subsequent?

From a technical perspective, Bitcoin might drop to $14,000 in 2022 if a drop under its present assist degree of round $18,800 triggers a “head-and-shoulders” breakdown.

Conversely, a rebound from the $18,800-support might have BTC’s worth eye $22,500 as its interim upside goal, or a 16.5% rise from Sept. 21’s worth

The views and opinions expressed listed below are solely these of the writer and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer includes danger, you must conduct your personal analysis when making a call.