Bitcoin (BTC) went on to hit its highest stage since Jan. 2 on March 28’s Wall Road open as its newest bull run saved up the tempo.

BTC dip nonessential however “could be wholesome”

Knowledge from Cointelegraph Markets Professional and TradingViewconfirmed BTC/USD reaching $47,900 on Bitstamp, simply $100 away from a brand new 2022 peak.

The transfer adopted a powerful transfer into the weekly shut, which continued on March 28, producing weekly beneficial properties of practically 17%.

It does not must occur however…

A #BTC dip could be wholesome

As a result of value would be capable to go forward and reclaim a earlier resistance as new assist

Similar goes for a lot of Altcoins which have loved robust strikes as of late$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) March 28, 2022

Whereas some started to name for a retracement to shore up new assist ranges, pleasure nonetheless remained because the driving temper on the time of writing.

“Multi-month regime of each spot premium and quarterlies backwardation + Huge on-chain accumulation by a number of measures. All we have been lacking is momentum,” Blockware lead insights analyst William Clemente explained.

“So long as $46K holds, suppose momentum/trend-based market members push this again to vary highs.”

That perspective was echoed by Rekt Capital, who recognized two key transferring averages as offering the potential gasoline to ship the most important cryptocurrency again to all-time highs.

The second #BTC is ready to breach the mid-range resistance…

Is the second that $BTC will ascend into the higher half of its Macro Re-Accumulation Vary#Crypto #Bitcoin pic.twitter.com/cJh2T4eiNP

— Rekt Capital (@rektcapital) March 28, 2022

Clemente added a chart displaying that Bitcoin’s transferring common convergence divergence (MACD) indicator had flipped inexperienced, signaling the beginning of an uptrend, for the primary time since November’s all-time highs.

On-chain monitoring useful resource Whalemap, in the meantime, reiterated that $47,400 was a key space on macro ranges due to accumulation having taken place there beforehand.

The macro outlook stays the identical as within the tweet under

47.4k is crucial stage within the 47k space proper now

Lets see how #Bitcoin reacts https://t.co/oAfqKLUKoa

— whalemap (@whale_map) March 28, 2022

In an extra nod to the present rally being extra sustainable than earlier ones this 12 months, analyst Philip Swift highlighted that funding charges on derivatives platforms remained curiously low regardless of optimism in each sentiment and market efficiency.

2022 “will not be that straightforward” for danger belongings

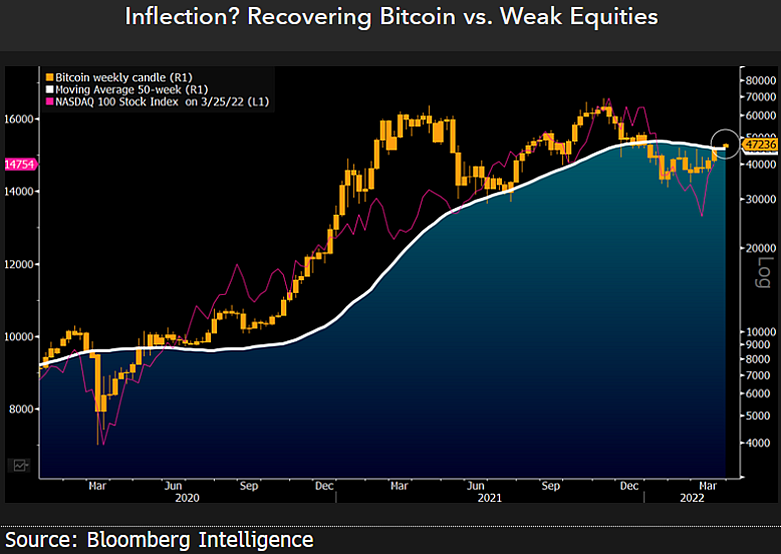

For macro analysts, the main focus was on whether or not Bitcoin was breaking out in opposition to conventional belongings with its newest beneficial properties.

Purchase strain ‘in bull market territory’ — 5 issues to know in Bitcoin this week

U.S. shares had been principally flat on March 28’s open, whereas gold loved solely a modest uptick.

Discussing the pattern, Mike McGlone, senior commodity strategist at Bloomberg Intelligence, queried whether or not BTC may be “taking the risk-off baton.”

“1Q could also be simply one other blip within the pattern of rising danger belongings amid the best inflation in 40 years and struggle in Europe, but our bias is that the 2022 endgame is not more likely to be that straightforward,” he reasoned.

McGlone added that Bitcoin was nonetheless “displaying divergent energy.”

The analyst had lately stated that BTC/USD might “simply” return to $30,000 earlier than attaining six figures in present macro circumstances.