Bitcoin (BTC) fell additional pre-Wall Road on Feb. 3 as evaluation revealed outdated resistance ranges had returned to hang-out bulls.

$38,600 is again

Knowledge from Cointelegraph Markets Professional and TradingViewpainted one other uninspiring image for BTC/USD Thursday, with the pair assembly new lows of $36,275 on Bitstamp.

After stunning tech inventory strikes throughout Wednesday’s buying and selling session, the knock-on impact for crypto remained palpable as main tokens struggled to stabilize.

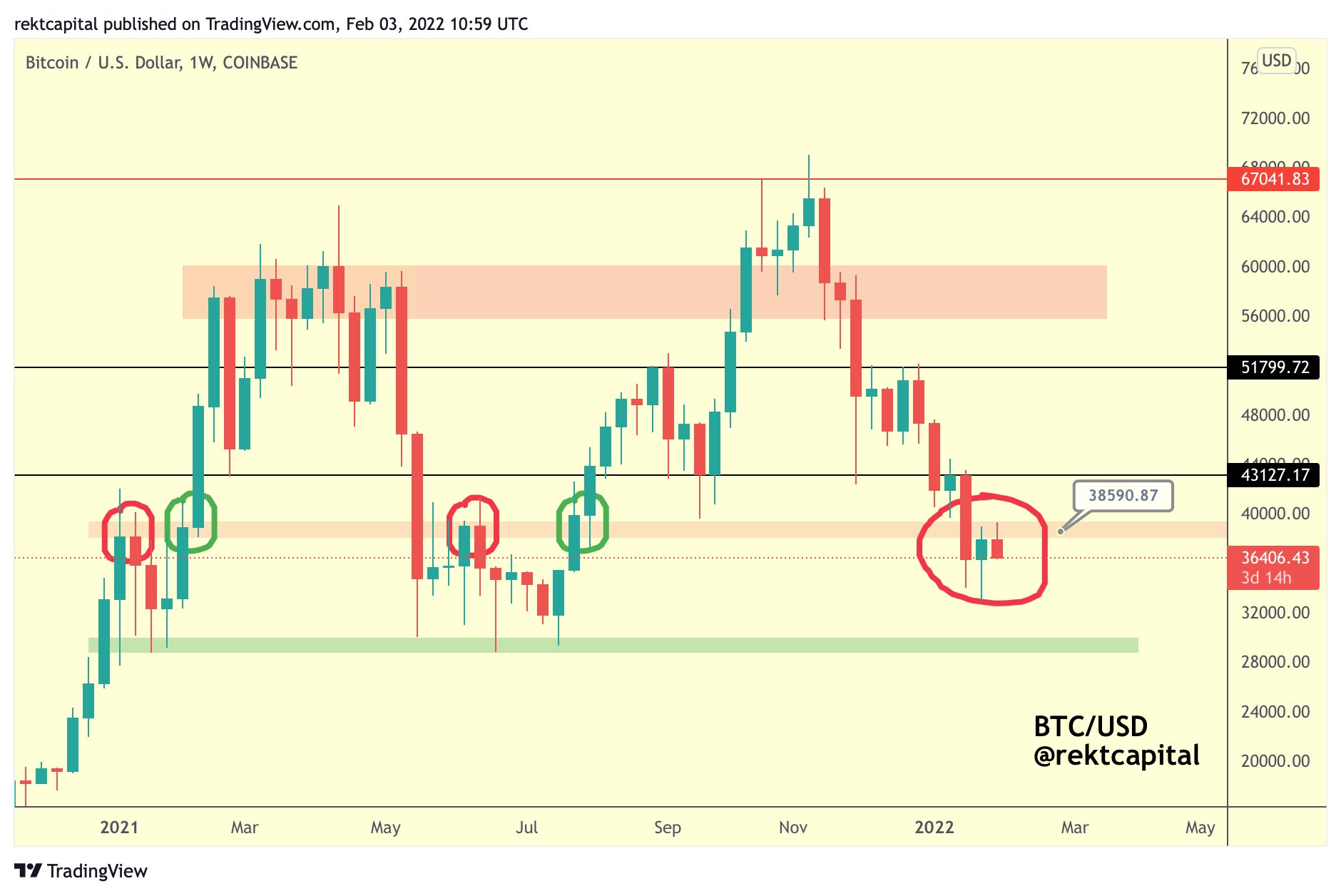

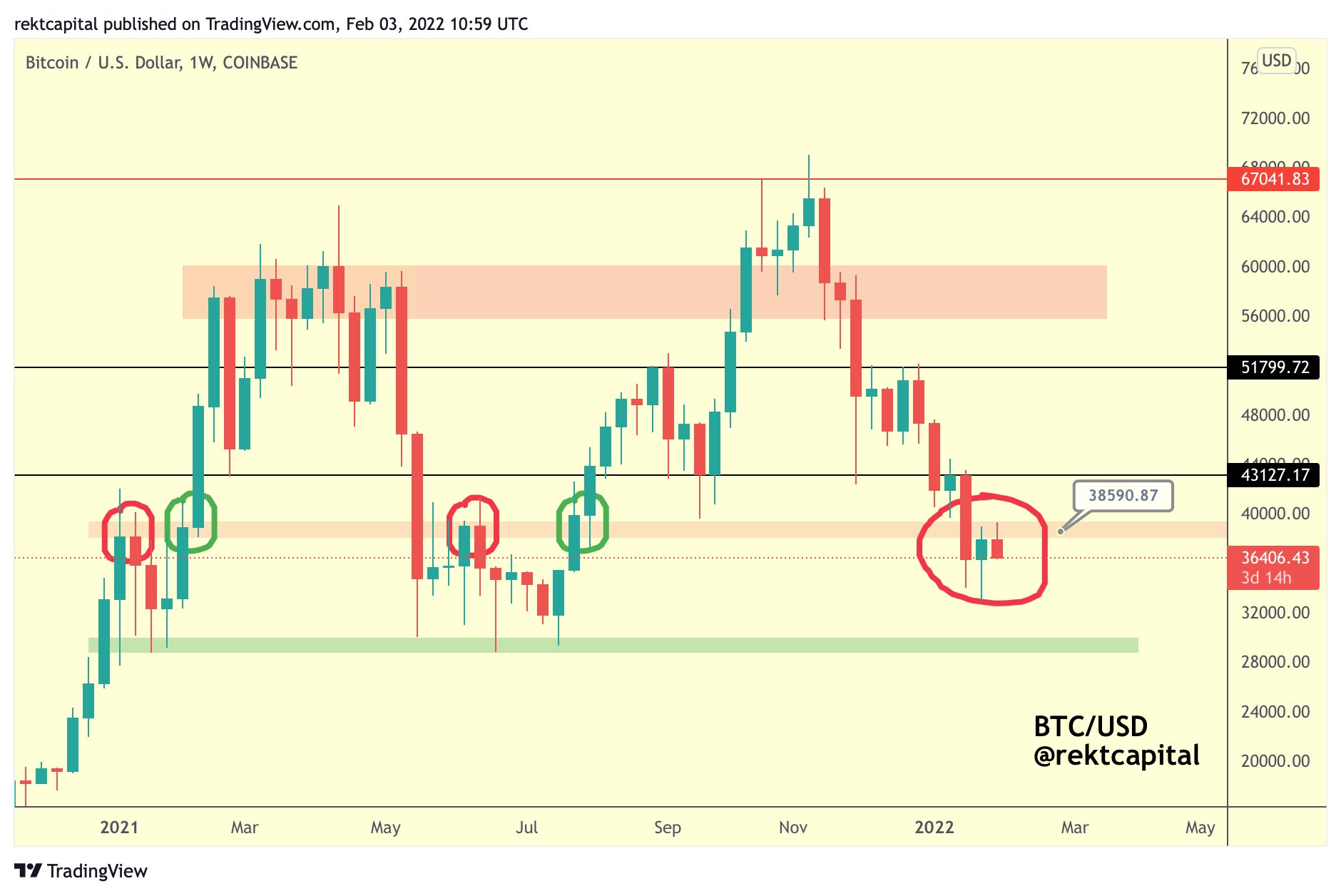

Zooming out, well-liked dealer and analyst Rekt Capital revealed the world at $38,600 — a stumbling block at a number of factors in 2021 — was as soon as once more appearing as a line within the sand for bulls to cross.

“Certainly, BTC produced an upside wick into resistance on its newest restoration,” he tweeted.

“In the meanwhile, this ~$38600 space continues to determine as resistance.”

For others, together with fellow dealer Anbessa, it was a case of “the decrease, the higher” for Bitcoin, this chiming with current expectations of a extra important breakdown occurring earlier than a full restoration.

#BTC Replace

– lifeless cat inside LTF rising wedge, breakout & continuation

– present assist ranges mid vary, M-neckline & downtrending channel (since Nov21)The decrease we go the higher r:r ratio for a brand new #midterm LONG entry. Eg nuke situation (proper) crowded grasping entry pic.twitter.com/nCJVcHiQjc

— AN₿ESSA (@Anbessa100) February 3, 2022

Tech inventory bother, in the meantime, erased optimistic sentiment from different macro cues, with Russia’s proposalto allowbanks to promote Bitcoin and India’s new crypto tax proposal taking a again seat.

Puell A number of returns to traditional oversold territory

Turning to on-chain metrics, it was the flip of the Puell Multiple this week to comply with Bitcoin’s relative energy index (RSI) in printing a serious “oversold” sign.

Bitcoin whales purchase at $38K as BTC provide per whale hits 10-year excessive

Created by David Puell, the favored indicator makes use of miner revenues relative to identify worth to find out when the latter is overly excessive or low.

At present, the Puell A number of is trending down and is already at its lowest since June 2021, the mid-point of a earlier retracement after China banned mining.