Bitcoin (BTC) consolidated beneath $40,000 on Might 5 after U.S. financial coverage pleasure noticed a spike to one-week highs.

Fed sparks little crypto response

Information from Cointelegraph Markets Professional and TradingViewconfirmed an in a single day peak of $40,050 on Bitstamp following feedback from the Federal Reserve and Chair Jerome Powell.

The U.S. central financial institution had conformed to market expectations with a 0.5% key charge hike, additionally suggesting that related repeat hikes would observe.

With that, a modest market rally left Bitcoin eerily missing volatility in what was a robust distinction to earlier Fed pronouncements on matters resembling inflation.

Whereas many anticipated threat property en masse — together with crypto — to deflate below the brand new coverage, not everybody believed that such a state of affairs would trigger buyers most discomfort.

“With so many individuals calling for soften ups and soften downs, possibly the ache commerce is to cut sideways in threat property for a very long time,” economist Lyn Alden argued.

Bitcoin circles likewise weren’t anticipating main development adjustments. Ben Lilly, a token economist at Jarvis Labs, highlighted low funding charges on BTC derivatives markets.

“Market noticed some reduction with Powell’s feedback. However will it proceed for the crypto market? To start out, funding charges have been destructive for an extended time frame. This tends to occur at vary lows,” he wrote in a collection of tweets.

“An excellent construction for any upward momentum that begins right here.”

Lilly added, however, that a lack of accumulation from whales at current price levels was “not what we hoped to see.”

“Max pain” for Bitcoin still far away

Focusing on lower timeframes, popular trader Crypto Ed held out for a fresh push above the $40,000 mark on May 5.

Bitcoin pushes to $40K, but are bulls strong enough to win Friday’s $735M options expiry?

For him, BTC/USD was in line to hit $40,800, and whereas there have been “loads of causes” to low cost a extra vital climb, it was nonetheless an possibility.

2/2

No, this isn’t a daring name for $43.5k in 1 go and earlier than finish of the week.

Will clarify the chart above in at present’s video.

That is probably the most very best state of affairs whereas there are many causes to suppose that is inconceivable.

Will attempt to do YT earlier than 10am, in any other case early afternoon— Ed_NL (@Crypto_Ed_NL) May 5, 2022

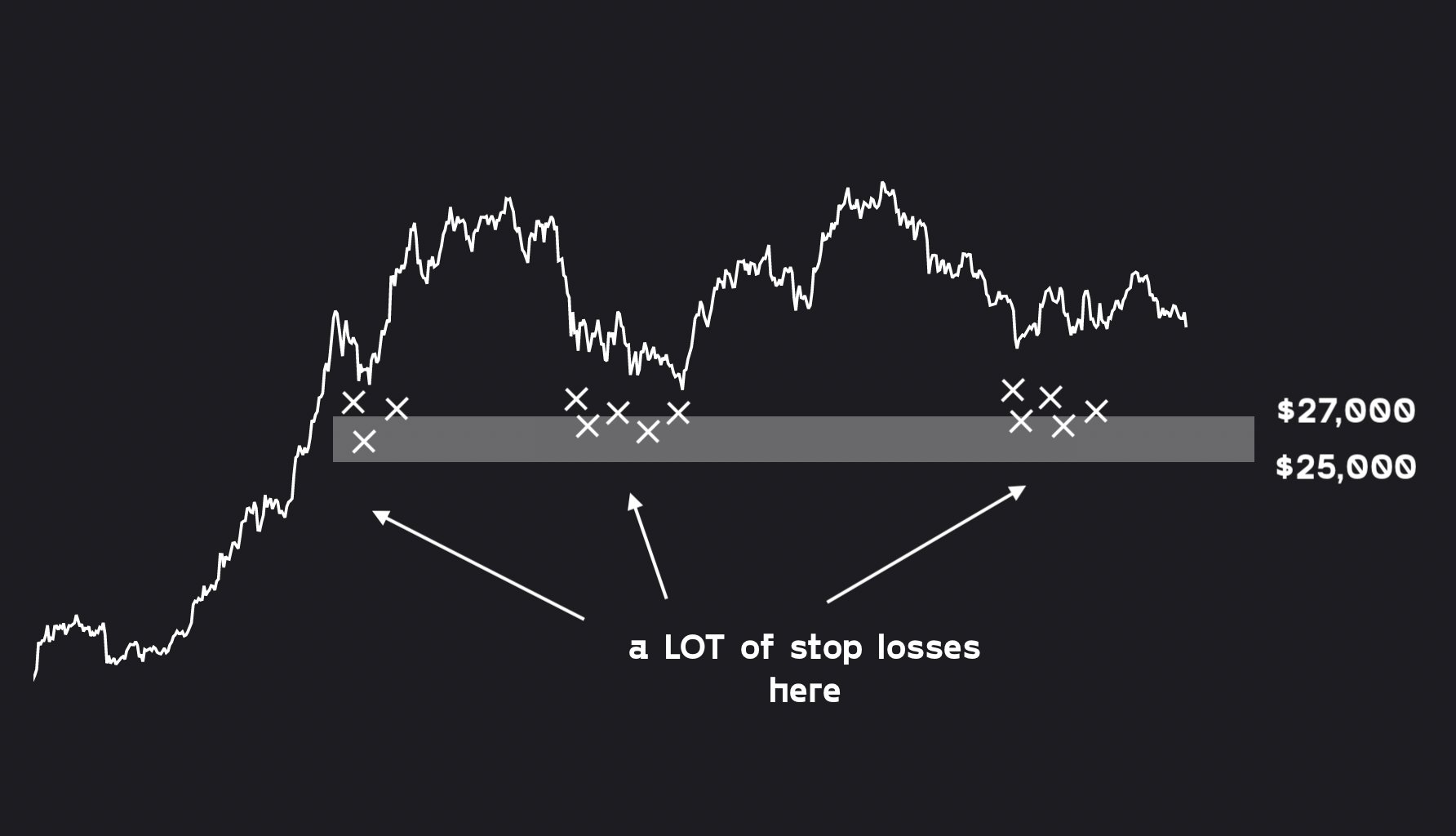

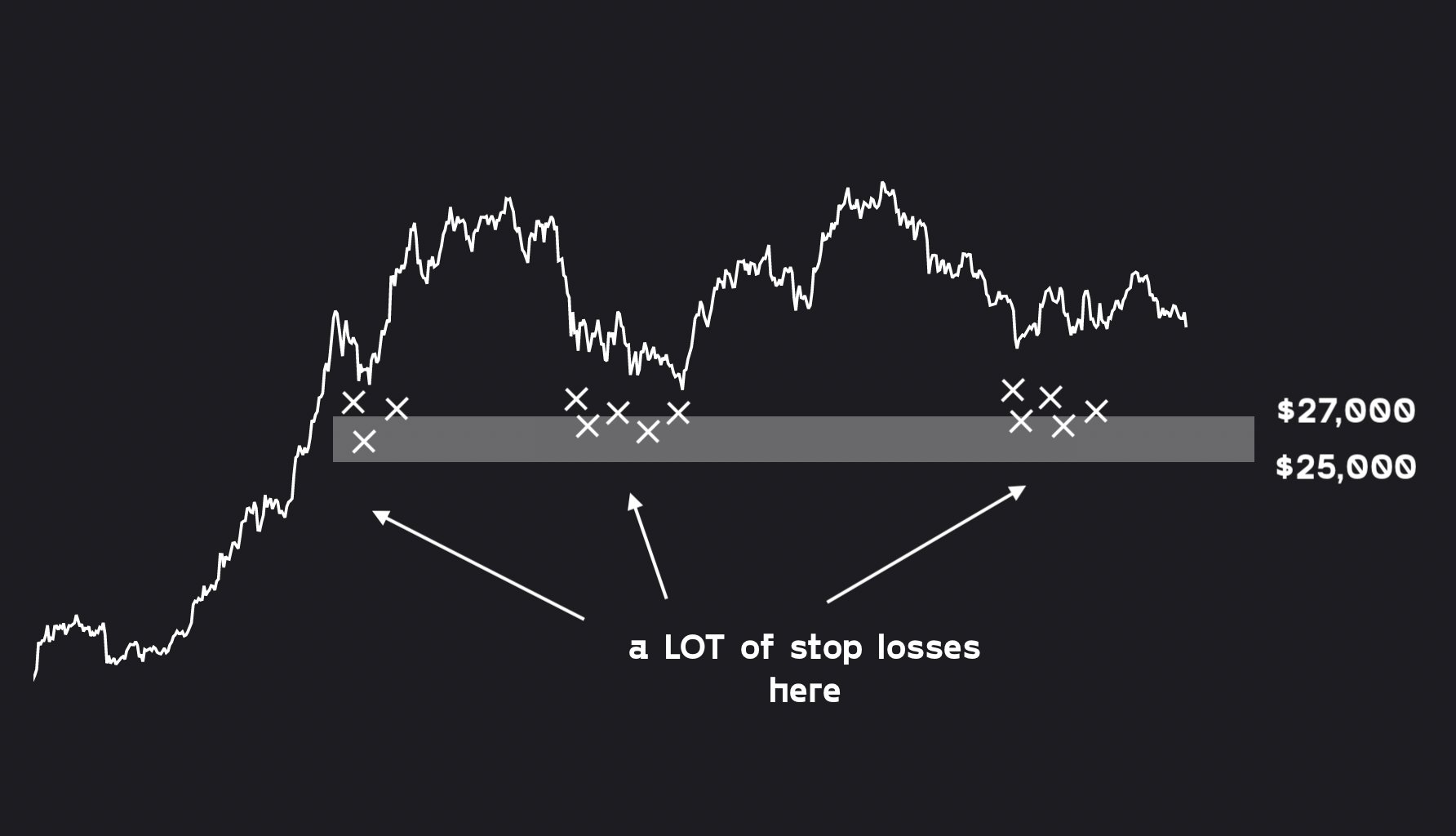

When it comes to BTC worth capitulation eventualities, in the meantime, on-chain monitoring useful resource Whalemap repeated its earlier assertion that the world between $25,000 and $27,000 would represent “max ache” for Bitcoin hodlers.

“Numerous liquidity and cease losses are stacked there,” it explained as a part of Twitter feedback.

The views and opinions expressed listed below are solely these of the creator and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer entails threat, you must conduct your individual analysis when making a call.