International monetary markets continued to face an uphill battle on April 7 following latest hawkish feedback from the US Federal Reserve hinting at a fast rise in rates of interest as one plan of action to assist curb rampant inflation.

Knowledge from Cointelegraph Markets Professional and TradingView reveals that the value of Bitcoin (BTC) hit an in a single day low of $42,744 following remarks by the Fed and has since entered a consolidation sample close to help at $43,500.

Right here’s a take a look at what a number of analysts out there are saying in regards to the outlook for Bitcoin at this degree and which help and resistance zones to keep watch over transferring ahead.

Bulls want to carry help at $43,100

Perception into what comes subsequent for Bitcoin based mostly on its earlier efficiency on this zone was touched on by market analyst and pseudonymous Twitter consumer Rekt Captial, who posted the next chart highlighting the importance of the $43,100 help degree.

Rekt Capital mentioned,

“If historical past repeats and BTC continues to take care of the ~$43,100 degree as help… then BTC may as soon as once more take pleasure in upside into the excessive $40,000s and even so far as the low $50,000s.”

BTC and the NASDAQ

The correlation between worth actions for Bitcoin and the NASDAQ was highlighted within the following chart posted by filbfilb, co-founder of buying and selling suite DecenTrader, who famous that “Since 2019, a number of selloffs at all-time highs on the NASDAQ have resulted in sharp selloff, which noticed BTC additionally appropriate on the identical time.”

Filbfilb mentioned,

“What adopted was an inverse head and shoulders bullish reversal, confirmed by testing the 50 DMA, and ATH on each legacy and BTC; a attainable situation forward.”

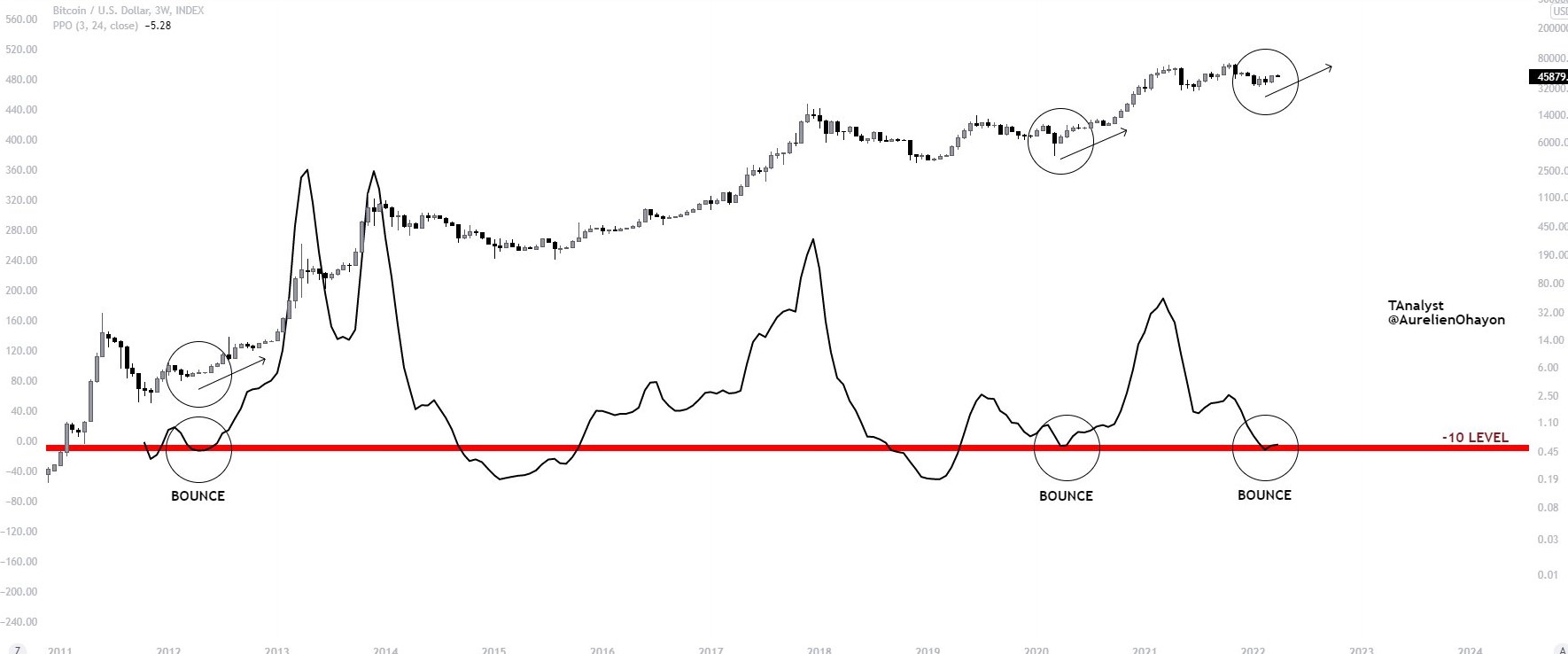

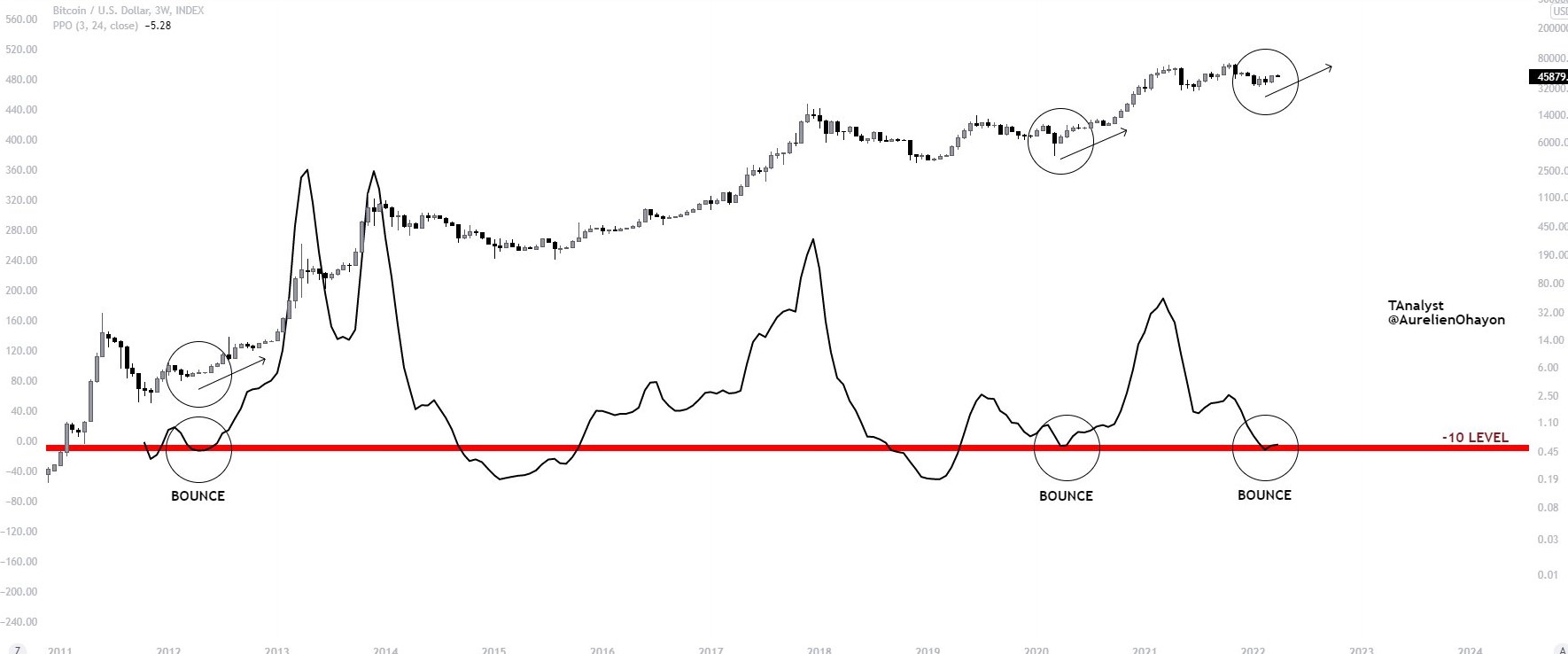

Additional proof to help a attainable impending breakout for BTC was offered by crypto analyst and pseudonymous Twitter consumer TAnalyst, who posted the next chart wanting on the worth motion for BTC when a bounce on the value oscillator happens.

TAnalyst mentioned,

“April 2012 worth oscillator bounce, then a bull run. March 2020 worth oscillator bounce, then a bull run. February 2022 worth oscillator bounce… I’ll [leave it to] you to conclude.”

Bitcoin sentiment falls into ‘worry’ as BTC worth motion hits $42.9K breakdown goal

A breakout to $57,000 or a pullback to $36,000

The lack of help at $44,700 was “anticipated after shedding that latest low” in line with crypto dealer and Cointelegraph contributor Michaël van de Poppe, who posted the next chart detailing the breakdown from $46,881.

Poppe mentioned,

“At present at an vital breaker. If we maintain this, all good, appears prepared for an additional leg to $57,000. If we do not, then I am seeing a check round $36,000.”

The general cryptocurrency market cap now stands at $2.015 trillion and Bitcoin’s dominance price is 41.2%.

The views and opinions expressed listed here are solely these of the writer and don’t essentially replicate the views of Cointelegraph.com. Each funding and buying and selling transfer includes threat, you must conduct your individual analysis when making a call.