Bitcoin (BTC) is in a combating temper this week because the weekly shut buoys bulls’ trigger and wipes out a number of weeks of draw back — can it proceed increased?

After difficult $42,000 over the weekend, there was a cautious sense of optimism as increased ranges remained in play. Sunday noticed a contemporary push, with in a single day progress attacking $43,000 earlier than contemporary consolidation.

With Monday’s Wall Avenue open primed to ship extra of the turbulence in massive tech shares seen late final week, the surroundings for crypto merchants is an attention-grabbing one in February.

With its notable optimistic correlation, Bitcoin is thus delicate to strikes up and down — however equities refuse to maneuver unanimously in the identical course.

In search of steerage, hodlers will nonetheless keep in mind January’s lows, and these are additionally contemporary within the thoughts of analysts who haven’t discounted the opportunity of returning to $30,000.

With one thing of per week of reckoning for its newest beneficial properties forward, Cointelegraph takes a have a look at the Bitcoin market and 5 forces at play that would assist form the place BTC worth motion heads subsequent.

Bitcoin dodges a significant breakdown

The weekend was no match for Bitcoin’s newfound bullishness regardless of its usually decrease quantity offering fertile floor for each “fakeouts” and “fakedowns.”

$40,000 held as help, and analysts had been eager to see $41,000 established as a longer-term foundation going ahead.

“This is how I see issues. So long as $BTC holds 39k (as prev said) then yearly open up subsequent,” dealer and analyst Pentoshi summarized Sunday.

“Imo 80% of alts will lag, 20% will lead/observe.”

The yearly open for 2022 stands at round $46,200, a worth degree that is getting nearer after BTC/USD broke by means of its weekend resistance zone to hit native highs of $43,070 on Bitstamp.

Fellow analyst and dealer Credible Crypto believes that the most recent motion may present proof that Bitcoin is starting its fifth in a sequence of impulse strikes stretching again a number of years.

My ideas on $BTC dominance at the moment. Lengthy story short- $BTC outperforms throughout preliminary levels of our ultimate fifth wave impulse, alts steal the present after that as $BTC tops, dominance makes a brand new all time low earlier than that is throughout. pic.twitter.com/mjklIIN444

— Credible Crypto (@CredibleCrypto) February 2, 2022

Ought to that be the case, it’s possible that altcoins will initially lose the limelight to BTC, he added, as with basic bull run efficiency.

“If my thesis is appropriate and $BTC is certainly beginning it is ultimate fifth wave right here, anticipate $BTC to steal the present, pump aggressively, alts to take an preliminary hit, however then rally/catch up similar to we noticed over the last two impulses (3-14k and 12-65k),” he explained.

Trying to the draw back, whales could maintain the reply. Knowledge from on-chain monitoring useful resource Whalemap reveals that the realm round $38,000 stays a big zone of curiosity for whales, who final week started including to their positions there.

Closest on-chain helps in case #BTC retraces pic.twitter.com/gcC00DbOg7

— whalemap (@whale_map) February 6, 2022

BTC/USD at $43,000 is in the meantime the very best since Jan. 17, the biggest cryptocurrency erasing greater than two weeks of losses in days.

Inflation stays “actual” earlier than January CPI readout

Shares shaped the springboard for Bitcoin’s exit from the $30,000-$40,000 hall final week, however “up solely” is hardly what characterizes main property.

Amongst massive tech, the story was one among Amazon’s beneficial properties and Meta’s losses, offering a curious dichotomy that Bitcoin finally used to its benefit.

Might the identical pattern proceed this week? Shares are usually not alone, as oil continues its personal beneficial properties and the inflationary narrative rises with it.

“Inflation goes kick the Fed’s _ss. Inflation is REAL,” veteran dealer Peter Brandt said Monday, eyeing U.S. bonds.

“This because of the flood of liquidity added in previous two years. $$$ abounds. The Fed is method behind the curve in elevating charges. The ten-Yr Be aware is headed to 2.35% within the near-term and three.0% over the following couple of years.”

He added that inflation stays extraordinarily modest in contrast with episodes over the last century, however that there may very well be a great distance nonetheless to climb.

Pentoshi in the meantime forecast an oil worth of greater than $100 incoming.

“Oil seems like it’ll barrel over $100 at this charge. 20% enhance within the first 5 weeks of the 12 months, 13% in January. In case you cherished inflation earlier than, you will find it irresistible when Oil is over $100. Client items numbers go up,” he tweeted.

Monday’s Wall Avenue open may thus present both a validation of Bitcoin’s beneficial properties or throw the occasion into jeopardy as soon as extra. On the time of writing, futures are pointing downhill after the S&P 500’s greatest week of 2022.

Knowledge in the meantime reveals that Bitcoin’s Nasdaq correlation is slowly ebbing.

Bitcoin’s 1D correlation to the Nasdaq is beginning to fall from traditionally excessive ranges pic.twitter.com/S4Sfa8nYrX

— Will Clemente (@WClementeIII) February 7, 2022

Thursday will see the discharge of January’s shopper worth index (CPI) knowledge, which may present additional headwinds for inflation ought to the figures fall exterior est

Will the greenback hold diving?

There’s one thing afoot with the U.S. greenback — at the same time as shares motor by means of early-year weak point.

In early February, a profitable streak spanning everything of 2021 abruptly turned bitter for USD bulls, and the previous week has seen straight draw back for the U.S. greenback foreign money index (DXY).

After passing 97 for the primary time in over a 12 months, DXY met with agency resistance and is now again under 95.6. Bar a short dip in mid-January, this represents its lowest degree since mid-November — simply as BTC/USD was making its present $69,000 all-time highs.

Analyzing the present setup, dealer, investor and entrepreneur Bob Loukas was sceptical.

“Very attention-grabbing strikes in $USD. Perhaps a lure?” he mused final week.

“One factor is for positive, Worth Motion is all the time WAY forward of what we expect (macro/occasions) needs to be driving worth.”

Bitcoin is traditionally inversely correlated to the DXY, and any sharp return to upside could undermine price strength easily.

“Not going to lie, but the DXY is starting to look like it wants to correct heavier,” Cointelegraph contributor Michaël van de Poppe likewise forecast.

He noted that the European Central Financial institution (ECB) holding off on rate of interest rises pressured the greenback additional.

“Long run -> could be sign for Bitcoin and risk-on property if the DXY is exhibiting extra weak point,” he argued.

Quick-term holders begin return to revenue

These searching for indicators {that a} longer-term Bitcoin worth backside genuinely being in needn’t hunt by means of a lot on-chain knowledge this week.

As famous by on-chain and cycle analytics account Root, the portion of the BTC provide managed by short-term hodlers is starting to tick upwards after falling to ranges which coincide with macro worth lows.

“Probably the macro backside is in,” Root commented Monday.

The spent output revenue ratio (SOPR) for short-term holders in the meantime saw its first in the meantime bounce above the 1 mark since Christmas this weekend.

Values climbing by means of 1 from under present that short-term holders on common are starting to promote at a revenue slightly than a loss.

On the subject of profitability, virtually 25% of the BTC provide stays underwater, in the meantime, in contrast with 16.7% of the provision bought between $30,000 and $41,500.

“Bitcoinis a bit high heavy right here, however NumberGoUp is medication for that,” Twitter account TXMC trades commented on the info from on-chain analytics agency Glassnode.

Sentiment eyes first exit from “worry” since all-time highs

The longer increased Bitcoin costs linger, the extra profound influence they’ve on even probably the most entrenched mindset.

Prime 5 cryptocurrencies to look at this week: BTC, ETH, NEAR, MANA, LEO

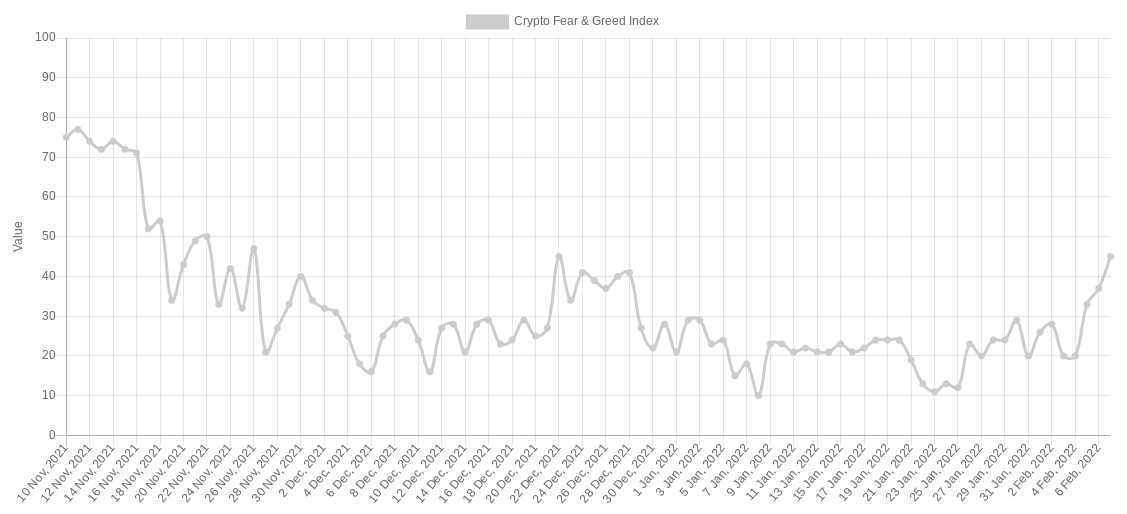

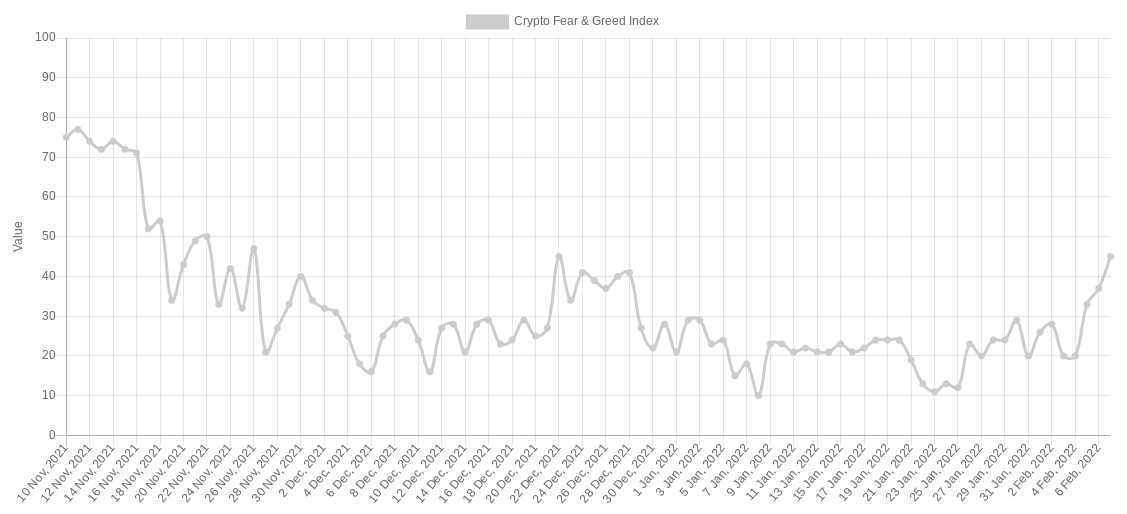

The Crypto Fear & Greed Index, which spent most of final month in its “excessive worry” zone, is now on the cusp of breaking out of “worry” altogether.

Such a transfer would mark the Index’s first shift to “impartial” territory for the reason that November report highs, and thus one thing of a reset of sentiment over the previous two-and-a-half months.

For comparability, only a week in the past, the Index stood at 20/100, whereas present ranges are 45/100 — greater than double on its normalized scale.

Historical past has proven that the important thing to sustainable sentiment, by which merchants don’t “pile in” to purchase or promote after particular worth motion, lies in measured BTC worth motion. “Gradual and regular” beneficial properties are what merchants are inclined to search for with a purpose to turn into assured of a longer-term pattern.

On the subject of January’s Index lows, nevertheless, analyst Philip Swift supplied a notice of warning.

“Charting Worry & Greed rating towards bitcoin worth reveals that the rating will be very low at factors that aren’t worth bottoms,” he noted final week, evaluating historic figures.

“However it’s attention-grabbing to notice that prolonged durations of Excessive Worry (sub 25) for +3wks does are inclined to sign main lows.”

The views and opinions expressed listed here are solely these of the creator and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer entails threat, it’s best to conduct your personal analysis when making a call.