It has been a tough week for the cryptocurrency market, primarily due to the Terra ecosystem collapseand its knock-on impact on Bitcoin (BTC), Ethereum (ETH) and altcoin costs, plus the panic promoting that befell after stablecoins misplaced their peg to the U.S. greenback.

The bearish headwinds for the crypto market have been constructing since late 2021 because the U.S. greenback gained power and the USA Federal Reserve hinted that it will elevate rates of interest all year long.

In accordance with a latest report from Delphi Digital, the 14-month RSI for the DXY has now “crossed above 70 for the primary time since its late 2014 to 2016 run up.”

That is notable as a result of 11 out of the 14 cases the place this beforehand occurred “led to a stronger greenback ~78% of the time over the next 12 months,” which factors to the chance that the ache for property might worsen.

On common, the DXY gained roughly 5.7% after its RSI rose above 70, which from Might 13’s studying “would put the DXY Index simply shy of 111, its highest degree since 2002.”

Delphi Digital stated,

“Assuming the correlation between the DXY and BTC stays comparatively robust, this may not be welcoming information for the crypto market.”

Bitcoin is at a key space for value bottoms

Taking an even bigger image method, BTCis now retesting its 200-week exponential shifting common (EMA) close to $26,990, which has “traditionally served as a key space for value bottoms” based on Delphi Digital.

Bitcoin can be persevering with to carry above its long-term weekly assist vary of $28,000 to $30,000, which has confirmed to be a robust space of assist all through the latest market turmoil.

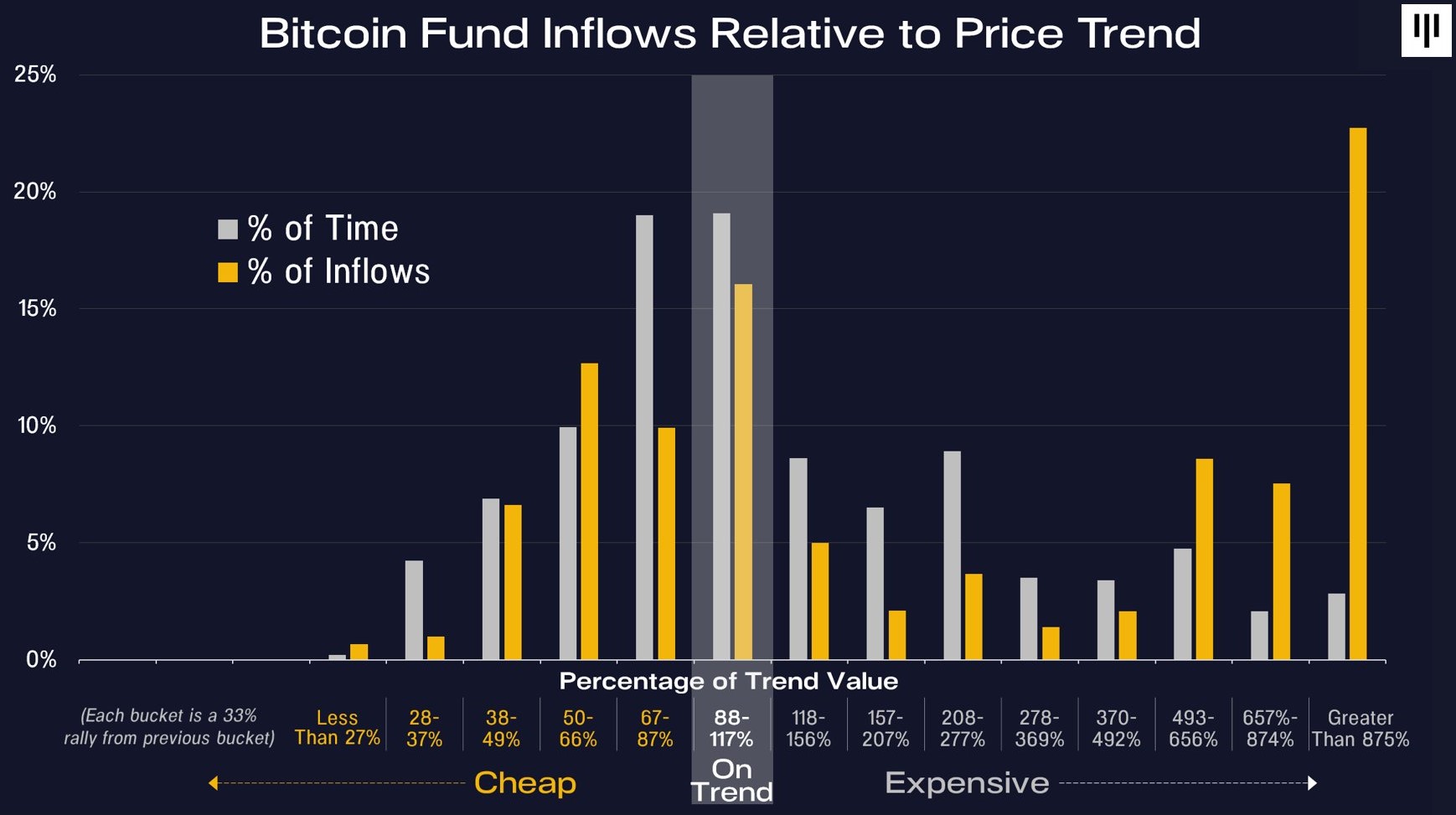

Whereas many merchants have been panic promoting in latest days, Pantera Capital CEO Dan Morehead has taken a contrarian method,noting, “It’s finest to purchase when [the] value is nicely under development. Now could be a type of occasions.”

Morehead stated,

“Bitcoin has been this “low-cost” or cheaper relative to development solely 5% of time since Dec 2010. In case you have the emotional and monetary sources, go the opposite manner.”

A phrase of warning was provided by Delphi Digital, nevertheless, which famous that “one of the best alternatives or “offers” available in the market usually are not round for lengthy.”

Since BTC has been buying and selling within the $28,000 to $30,000 vary for an prolonged time frame, “the longer we see value construct in these areas, additional continuation turns into extra doubtless.”

If additional decline happens, the “weekly construction and quantity construction assist at $22,000 to $24,000” and the “2017 all-time excessive retests of $19,000 to $24,000” are the following main areas of assist.

Delphi Digital stated,

“Early indicators of capitulation are beginning to bleed via, however we are able to’t say we’re nearing the purpose of max ache simply but.”

The views and opinions expressed listed here are solely these of the writer and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer includes danger, you need to conduct your personal analysis when making a choice.