The cryptocurrency market settled right into a holding sample on Might 25 after merchants opted to sit down on the sidelines forward of the noon Federal Open Market Committee (FOMC) assembly the place the Federal Reserve signaled that it intends to proceed on its path of elevating rates of interest. In accordance with data from Various.me, the Worry and Greed Index seeing its longest run of utmost worry for the reason that market crash in Mach 2020.

Knowledge from Cointelegraph Markets Professional and TradingView exhibits that the value motion for Bitcoin (BTC) has continued to compress into an more and more slim buying and selling vary, however technical evaluation indicators are usually not offering a lot perception on what course a potential breakout may take.

Right here’s a have a look at what analysts suppose may come subsequent for Bitcoin value.

Whales accumulate as Bitcoin battles to reclaim $30,000

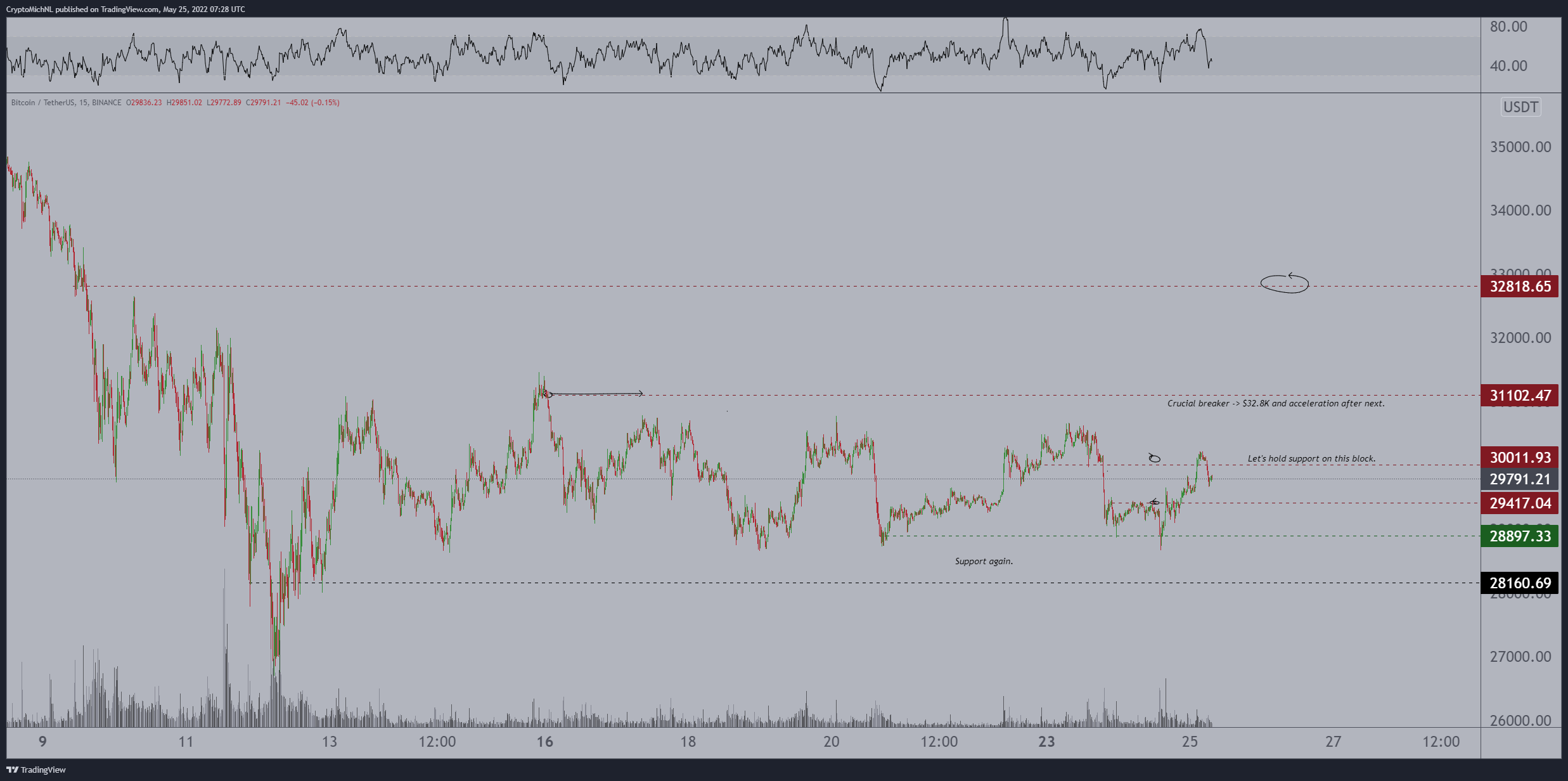

According to market analyst Michaël van de Poppe, “#Bitcoin broke by $29.4K and ran in the direction of the following resistance zone. If we maintain $29.4K, we’ll be good in the direction of $32.8K. Lastly.”

One attention-grabbing factor to notice at these value ranges is that whereas the predominant sentiment is that of utmost worry, on-chain intelligence agency Santiment pointed out that whale wallets have taken this as a chance to build up some well-priced BTC.

Santiment mentioned,

“As #Bitcoin continues treading water at $29.6K, the quantity of key whale addresses (holding 100 to 1k $BTC) continues rising after the huge dumping from late January. We have traditionally seen a correlation between value & this tier’s handle amount.”

Worth may nonetheless pull again to $22,500

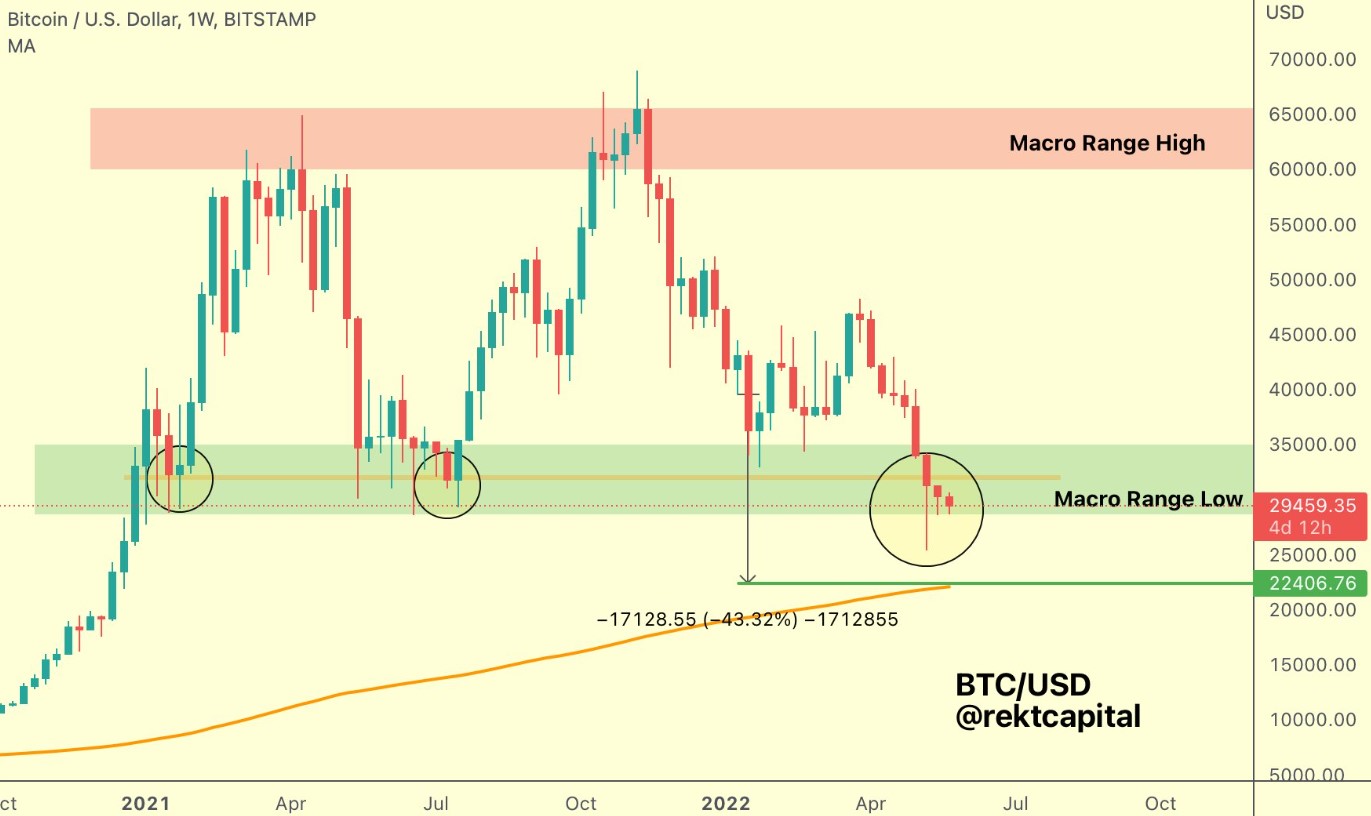

A macro perspective on how Bitcoin performs following the looks of a demise cross was provided by pseudonymous Twitter person Rekt Capital, who posted the next chart outlining what to anticipate if the “historic value tendencies regarding the #BTC Loss of life Cross repeat […]”

Rekt Capital mentioned,

“$BTC will breakdown from the Macro Vary Low assist & proceed its drop to finish -43% draw back. The -43% mark is confluent with the 200-Week MA at ~$22500.”

Scott Minerd says Bitcoin value will drop to $8K, however technical evaluation says in any other case

“A pivotal retest”

The significance of the present value degree for Bitcoin was touched upon by economist Caleb Franzen, who posted the next chart trying on the long-term efficiency of BTC versus its weekly anchored volume-weighted common value (AVWAP) noting that “This can be a pivotal retest, just like the dynamics in March 2022.”

Franzen mentioned,

“A rebound on the weekly AVWAP from the COVID low may enhance bullish chances. A breakdown beneath it might drastically enhance bearish chances, foreshadowing a retest of the gray vary, $13.8k-19.8k.”

The general cryptocurrency market cap now stands at $1.265 trillion and Bitcoin’s dominance fee is 44.8%.

The views and opinions expressed listed here are solely these of the creator and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer entails threat, it’s best to conduct your personal analysis when making a choice.