Bitcoin (BTC) begins a brand new week in an odd place — one which is eerily just like the place it was this time final 12 months.

After what numerous sources have described as a complete twelve months of “consolidation,” BTC/USD is round $42,000 — nearly precisely the place it was in week two of January 2021.

The ups and downs in between have been important, however primarily, Bitcoin stays within the midst of a now acquainted vary.

The outlook varies relying on the attitude — some consider that new all-time highs are greater than doable this 12 months, whereas others are calling for a lot of extra consolidatory months.

With crypto sentiment at a few of its lowest ranges in historical past, Cointelegraph takes a have a look at what might change the established order on shorter timeframes within the coming days.

Will $40,700 maintain?

Bitcoin noticed a making an attempt weekend as the newest in a sequence of abrupt downward strikes noticed $40,000 help inch nearer.

Knowledge from Cointelegraph Markets Professional and TradingView confirmed BTC/USD hitting $40,700 on main exchanges earlier than bouncing, a correction which has since held.

Satirically, it was that very stage which was in give attention to the identical day in 2021, that nonetheless coming throughout what turned out to be the extra vertical part of Bitcoin’s current bull run.

Final September additionally returned the main focus to $40,700, which acted as a turning level after a number of weeks of correction and finally noticed BTC/USD climb to $69,000 all-time highs.

Now, nevertheless, the possibilities of a breakdown to the $30,000 zone are unreservedly greater amongst analysts.

“Weekly Shut is simply across the nook,” Rekt Capital summarized alongside a chart with goal ranges.

“Theoretically, there’s a probability that $BTC might carry out a Weekly Shut above ~$43200 (black) to get pleasure from a inexperienced week subsequent week. Weekly Shut below ~$43200 nevertheless & BTC might revisit the purple space under.”

Bitcoin finally closed at $42,000, since hovering at round that stage in what might develop into some short-term reduction for bulls.

“I feel market places in a decrease excessive,” fellow dealer and analyst Pentoshi forecast, including that he believes $40,700 will finally fall.

An more and more alluring goal, in the meantime, lies eventually summer time’s $30,000 ground.

Consensus kinds over dire outlook for money

The macro image this week is especially difficult for danger asset followers, with Bitcoin and altcoins no exception.

What the longer term holds, nevertheless, varies significantly from one pundit to a different.

The US Federal Reserve is broadly seen to start out elevating rates of interest within the coming months, this making buyers de-risk and inflicting a headache for crypto bulls. “Straightforward cash,” which started flowing in March 2020, will now be a lot tougher to return by.

The bearish viewpoint was summarized neatly by ex-BitMEX CEO, Arthur Hayes, in his newest weblog submit final week.

“Let’s neglect what non-crypto buyers consider; my learn on the sentiment of crypto buyers is that they naively consider community and person development fundamentals of all the advanced will enable crypto belongings to proceed their upward trajectory unabated,” he wrote.

“To me, this presents the setup for a extreme washout, because the pernicious results of rising rates of interest on future money flows will probably immediate speculators and buyers on the margin to dump or severely scale back their crypto holdings.”

This week sees the U.S. client value index (CPI) information for December launched, numbers which is able to probably feed into the story of shock inflation features.

Hayes is much from alone in worrying over what the Fed could convey to crypto this 12 months, with Pentoshi amongst others likewise calling a brief finish to the bull run.

“And the ultimate query is, can crypto ignore the Fed if it decides to go all out wielding a deflationary machete? I doubt it,” analyst Alex Krueger concluded in a series of tweets on the problem this weekend.

“‘Do not battle the Fed’ applies each methods, up and down. If the Fed is *too hawkish* then Houston, we’ve an issue.”

There have been some optimists left within the room. Dan Tapiero, Founder and CEO of 10T Holdings, instructed followers to “ignore” the current rout and give attention to an unchanged long-term funding alternative.

“Most bullish macro backdrop in 75 years,” he said.

“Booming economic system supported by huge damaging actual charges. Fed won’t ever equalize charges with inflation. Keep lengthy shares and Bitcoin and ETH. Hodl via quick time period volatility. Actual Greenback money financial savings will proceed to lose worth.”

Here is a have a look at the Efficient Fed Funds Price and Inflation Charges when the Unemployment Price was at 3.9%, as it’s right now.

Discover the outlier… pic.twitter.com/zU1zRj1uXC

— Charlie Bilello (@charliebilello) January 7, 2022

Tapiero highlighted information compiled by Charlie Bilello, founder and CEO of Compound Capital Advisors.

RSI hits two-year lows

Amid the gloom, not every little thing is pointing to a protracted bearish part for Bitcoin particularly.

As Cointelegraph has been reporting, on-chain indicators are calling for upside in droves — and historic context serves to help these calls for.

This week, it’s Bitcoin’s relative energy index (RSI) which continues to headline, reaching its lowest ranges in two years.

#Bitcoin RSI has been this low simply 2 different occasions within the final 2 years. Seems like a backside is close to and bounce due. Let’s examine pic.twitter.com/qhQ1pD8yEl

— Bitcoin Archive (@BTC_Archive) January 9, 2022

RSI is a key metric used to find out whether or not an asset is “overbought” or “oversold” at a given value level.

Plumbing the depths at $42,000 means that such a stage actually is taken into account too excessive by the market, and a rebound ought to happen to steadiness it.

Against this, final January, RSI was sky excessive and conversely properly inside “overbought” territory, whereas BTC/USD traded on the similar value.

“The Bitcoin RSI is on the bottom level in 2 years on the day by day. March 2020 & Could 2021 had been the final ones. And other people flip bearish right here / wish to quick,” a hopeful Cointelegraph contributor Michaël van de Poppe commented.

Cointelegraph famous equally bullish hints on the month-to-month RSI chart final week.

Hash fee recoups Kazakhstan losses

One other blip from final week already “curing itself” comes from the realm of Bitcoin fundamentals.

After hitting new all-time highs all through current weeks, Bitcoin’s community hash fee took successful when turbulence in Kazakhstan comprised web availability.

Kazakhstan, house to round 18% of hash fee, has since stabilized, permitting the hash fee to largely return to prior ranges of 192 exahashes per second (EH/s).

At one level all the way down to 171 EH/s, responses to what could have reminded a few of final Could’s China mining ban seem to have lifted hash fee and preserved record-breaking miner participation.

Bitcoin’s network difficulty, regardless of the upheaval, nonetheless managed to place in a modest enhance this weekend and is at present on monitor to take action once more at its subsequent automated readjustment in just below two weeks.

“Going up ceaselessly,” on-chain analyst Dylan LeClair commented concerning the traditional mantra, “value follows hash fee.”

For context, China’s mining rout triggered hash fee to say no by 50%. It took round six months to recoup the losses.

“What if…?”

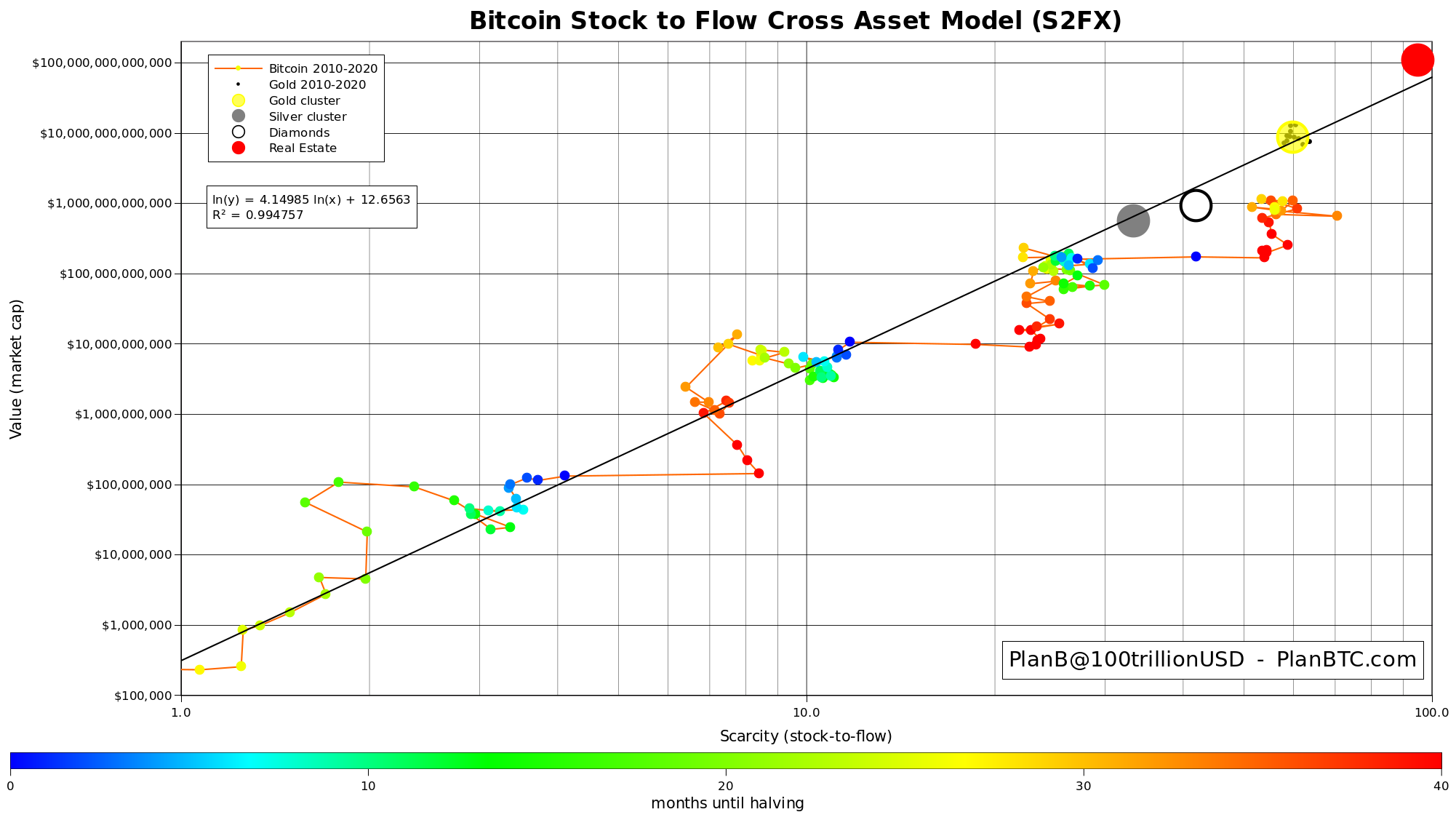

Somebody who has lengthy been saying that it’s excessive time for a Bitcoin development reversal is quant analyst PlanB, creator of the stock-to-flow-based BTC value fashions.

Prime 5 cryptocurrencies to look at this week: BTC, LINK, ICP, LEO, ONE

Presently weathering a check of his creations — and the accompanying storm of social media criticism — PlanB nonetheless stays extra optimistic than most in terms of mid to long-term value motion.

“I do know some folks have misplaced religion on this bitcoin bull market,” he acknowledged this weekend.

“Nonetheless we’re solely midway into the cycle (2020-2024). And though BTC experiences some turbulence at $1T, the yellow gold cluster at S2F60/$10T (small black dots are 2009-2021 gold information) continues to be the goal IMO.”

He was referring to the stock-to-flow worth for Bitcoin, gold and different belongings as a part of his stock-to-flow cross-asset (S2FX) mannequin, which requires a mean BTC/USD value of $288,000 throughout the present halving cycle.

Nearer to house, nevertheless, a extra simplified comparability between Bitcoin this cycle and its two earlier ones noticed a possible trajectory starting with a U-turn now.

What if … pic.twitter.com/te36HkFAbQ

— PlanB (@100trillionUSD) January 9, 2022

A separate mannequin, the ground mannequin, which demanded $135,000 per bitcoin by the tip of December, has now been discarded after failing to hit its goal for the primary time ever in November.