Bitcoin’s (BTC) present 20% drop over the previous 4 days has put the worth at its lowest degree in 9 months and whereas these actions may appear extraordinary, fairly various giant listed firms and commodities confronted an identical correction. For instance, pure gasoline futures corrected 15.5% in 4 days and nickel futures traded down 8% on Might 9.

Different casualties of the correction embody a number of $10 billion and better market capitalization firms which are listed at U.S. inventory exchanges. Invoice.com (BILL) traded down 30%, whereas Cloudflare (NET) offered a 25.4% worth correction. Dish Community (DISH) additionally confronted a 25.1% drop and Ubiquiti’s (UI) worth declined by 20.4%.

Persistent weak financial information signifies {that a} recession is coming our approach. On the identical time, the U.S. Federal Reserve reverted its expansionary incentives and now goals to scale back its stability sheet by $1 trillion. On Might 5, Germany additionally reported manufacturing facility orders declining by 4.7% versus the earlier month. The U.S. unit labor prices offered an 11.6% improve on the identical day.

This bearish macroeconomic state of affairs can partially clarify why Bitcoin and danger belongings proceed to right however taking a more in-depth have a look at how skilled merchants are positioned may also present helpful perception.

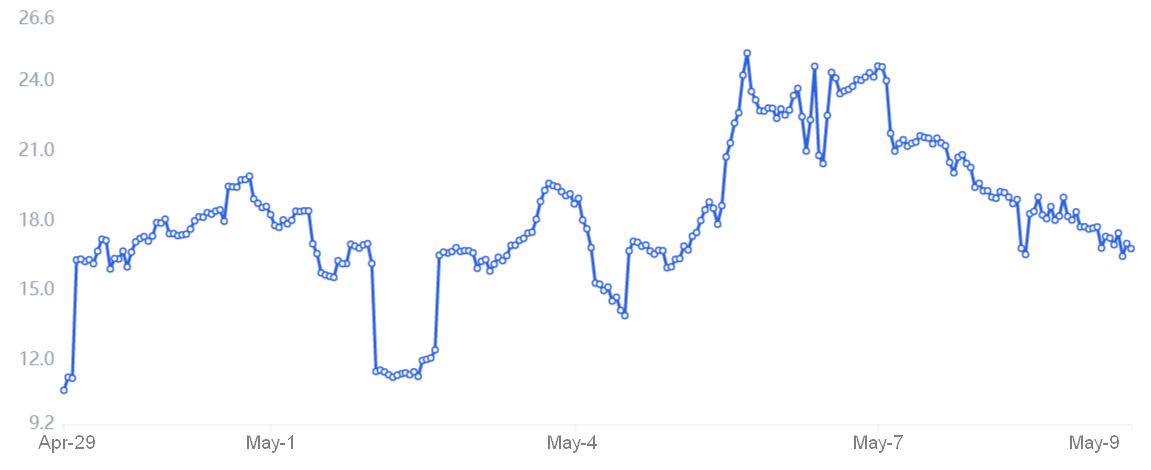

Bitcoin’s futures premium stabilized at 2.5%

To know whether or not the latest worth motion displays prime merchants’ sentiment, one ought to analyze Bitcoin’s futures contracts premium, in any other case referred to as the “foundation price.”

Not like a perpetual contract, these fixed-calendar futures wouldn’t have a funding price, so their worth will differ vastly from common spot exchanges. The three-month futures contract trades at a 5% or decrease annualized premium every time these professional merchants flip bearish.

However, a impartial market ought to current a 5% to 12% foundation price, reflecting market individuals’ unwillingness to lock in Bitcoin for affordable till the commerce settles.

The above information exhibits that Bitcoin’s futures premium has been decrease than 5% since April 6, indicating that futures market individuals are reluctant to open leverage lengthy positions.

Even with the above information, the latest 20% worth correction was not sufficient to drive this metric under the two% threshold, which needs to be interpreted as optimistic. Bulls definitely wouldn’t have a motive to have fun, however there are not any indicators of panic promoting from the perspective of futures markets.

Choices merchants stepped deeper into the “worry” zone

To exclude externalities particular to the futures contracts, merchants also needs to analyze the choices markets. The most straightforward and efficient metric is the 25% delta skew, which compares equal name (purchase) and put (promote) choices.

In brief, the indicator will flip optimistic when “worry” is prevalent as a result of the protecting put choices premium is increased than the decision (bullish) choices. However, a unfavorable 25% skew signifies bullish markets. Lastly, readings between unfavorable 8% and optimistic 8% are often deemed impartial.

The above chart exhibits that Bitcoin possibility merchants have been signaling “worry” since April 8 after BTC broke under $42,500. Not like futures markets, choices major sentiment metric confirmed a worsening situation over the previous 4 days because the 25% delta skew presently stands at 14.5%.

To place issues in perspective, the final time this choices market’s “worry & greed” indicator touched 15% was on January 28, after Bitcoin worth traded down 23.5% in 4 days.

The bullish sentiment of margin markets peaked

Merchants also needs to analyze margin markets. Borrowing crypto permits traders to leverage their buying and selling place and probably improve their returns. For instance, a dealer can borrow Tether (USDT) and use the proceeds to spice up their Bitcoin publicity.

However, borrowing Bitcoin permits one to wager on its worth decline. Nonetheless, the stability between margin longs and shorts will not be at all times matched.

Knowledge exhibits that merchants have been borrowing extra Bitcoin just lately, because the ratio declined from 24.5 on Might 6 to the present 16.8. The upper the indicator, the extra assured skilled merchants are with Bitcoin’s worth.

Regardless of some latest Bitcoin borrowing exercise geared toward betting on the worth downturn, margin merchants stay largely optimistic, in accordance with the USDT/BTC lending ratio. Usually, numbers above 5 mirror bullishness and the latest 24.5 peak was the very best degree in additional than six months.

In accordance with derivatives metrics, Bitcoin merchants are afraid of a deepening correction as macroeconomic indicators deteriorate. Nonetheless, traders additionally count on a possible disaster in conventional markets, so Bitcoin’s 20% correction merely follows that of broader danger belongings.

On a optimistic observe, there are not any indicators of leverage brief (unfavorable) bets utilizing margin or futures, that means there may be little conviction from sellers at present worth ranges.

The views and opinions expressed listed below are solely these of the author and don’t essentially mirror the views of Cointelegraph. Each funding and buying and selling transfer includes danger. You need to conduct your personal analysis when making a call.