The $4,700 Bitcoin (BTC) worth spike on Nov. 29 was seemingly an amazing aid for holders, however it appears untimely to name the underside in line with spinoff metrics.

This could not come as a shock as a result of Bitcoin worth remains to be 15% beneath the $69,000 all-time excessive set on Nov. 10. Simply 15 days later, the cryptocurrency was testing the $53,500 assist after an abrupt 22% correction.

Right this moment’s pattern reversal was presumably inspired by MicroStrategy’s announcement that it had acquired 7,002 Bitcoin on Monday at a mean worth of $59,187 per coin. The listed firm raised cash by promoting 571,001 shares between Oct. 1 and Nov. 29, elevating a complete of $414.4 million in money.

Extra bullish information got here after German inventory market operator Deutsche Boerse introduced the itemizing of the Invesco Bodily Bitcoin exchange-traded notice or ETN. The brand new product will commerce underneath the ticker BTIC on Deutsche Boerse’s Xetra digital inventory alternate.

Knowledge reveals professional merchants are nonetheless neutral-to-bullish

To grasp how bullish or bearish skilled merchants are positioned, one ought to analyze the futures foundation charge. That indicator is also called the futures premium, and it measures the distinction between futures contracts and the present spot market at common exchanges.

Bitcoin’s quarterly futures are the popular devices of whales and arbitrage desks. Regardless that derivatives might sound sophisticated for retail merchants because of their settlement date and worth distinction from spot markets, probably the most infamous profit is the dearth of a fluctuating funding charge.

The three-month futures usually commerce with a 5%–15% annualized premium, which is deemed a possibility value for arbitrage buying and selling. By suspending settlement, sellers demand the next worth and this causes the worth distinction.

Discover the 9% backside on Nov. 27, as Bitcoin examined the $56,500 assist. Then, after Monday’s rally above $58,000, the indicator shifted again to a wholesome 12%. Even with this motion, there is no such thing as a signal of pleasure, however not one of the previous few weeks may very well be described as a bearish interval.

Key information factors counsel the crypto market’s short-term correction is over

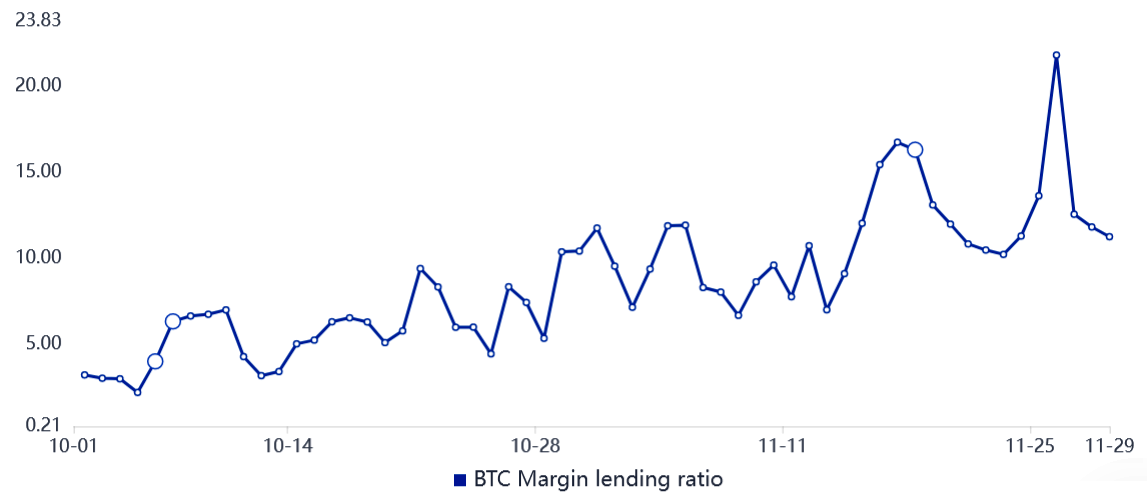

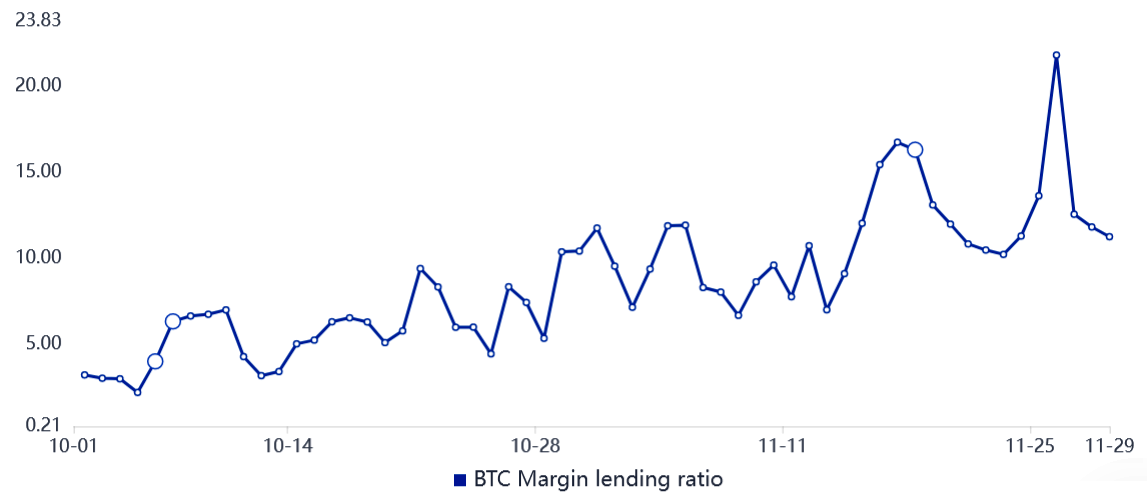

Lending markets present extra perception

Margin buying and selling permits buyers to borrow cryptocurrency to leverage their buying and selling place, due to this fact growing the returns. For instance, one should buy Bitcoin by borrowing Tether (USDT), thus growing the publicity. However, borrowing Bitcoin can solely be used to quick it or wager on the worth lower.

In contrast to futures contracts, the steadiness between margin longs and shorts isn’t essentially matched.

When the margin lending ratio is excessive, it signifies that the market is bullish—theopposite, a low lending ratio alerts that the market is bearish.

The chart above reveals that merchants have been borrowing extra Bitcoin not too long ago, as a result of the ratio decreased from 21.9 on Nov. 26 to the present 11.3. Nevertheless, the info leans bullish in absolute phrases as a result of the indicator favors stablecoin borrowing by a large margin.

Derivatives information reveals zero pleasure from professional merchants at the same time as Bitcoin gained 9% from the $53,400 low on Nov. 28. In contrast to retail merchants, these skilled whales keep away from FOMO, though the margin lending indicator reveals indicators of extreme optimism.

The views and opinions expressed listed below are solely these of the author and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer includes danger. It is best to conduct your individual analysis when making a choice.