In his month-to-month crypto tech column, Israeli serial entrepreneur Ariel Shapira covers rising applied sciences inside the crypto, decentralized finance (DeFi) and blockchain house, in addition to their roles in shaping the financial system of the twenty first century.

The crypto market, simply as every other market, runs in cycles. Although digital property are recognized, if not notorious, for being extra risky than many different asset sorts, their value motion nonetheless follows a well-recognized sample of ups and downs. A few of this, equivalent to Bitcoin’s (BTC) four-year cycle, largely comes right down to the algorithm’s intrinsic guidelines — extra particularly, the halving of miners’ rewards. Off-chain elements, such because the U.S. tax-reporting guidelines, can even come into play.

Nonetheless, whereas the market’s logic dictates change, the logic itself stays largely unchanging. In different phrases, in the identical method a bull run ultimately runs out of steam and hits a plateau, bears ultimately lose grasp of the market as effectively, giving solution to one other upshoot.

For now, in fact, the market continues to be recovering from Terra’s crash and plenty of different pressures that there was no scarcity of previously few years. As fragile as its rebound makes an attempt could also be, and as purple as each coin is in comparison with only a few months in the past, the worldwide crypto scene is hunkering down and powering on in wait for an additional bull run. So, the place may it come from?

Methods to survive in a bear market? Ideas for newcomers

Nationwide governments

Just some years in the past, the very concept that Bitcoin could possibly be authorized tender in any given nation appeared like a far-fetched delusion. And but, after El Salvador’s daring Bitcoin gambit, the Central African Republic (CAR) joined the fray in late April, granting Bitcoin and different cryptocurrencies the standing of authorized tender.

These two nations make for an fascinating comparability. It’s by now frequent information within the crypto house that remittances from overseas make up a significant portion of El Salvador’s funds, and this truth was seen because the financial rationale behind the experiment. Whereas reviews suggest the method is shaky, the nation’s authorities does shop for Bitcoin, embracing the “purchase the dip” stratagem.

With the CAR, issues couldn’t have been extra totally different. The financial system of the war-ravaged nation has been ailing for fairly a while. Moreover, solely about 10% of the nation’s inhabitants has web entry, in line with World Financial institution data. In different phrases, using crypto will seemingly be restricted to a small portion of the inhabitants — and, given the geopolitical and native context of the transfer, the prospects can certainly be fairly murky.

Nonetheless, extra rising economies might select to comply with swimsuit, particularly provided that El Salvador isn’t the one nation leaning loads on remittance transfers for funds money. Even the truth that there’s precedent for that’s large enough to get the momentum going, and may even another nation be part of the membership this 12 months, the crypto markets will realize it.

El Salvador’s Bitcoin Legislation: Understanding options to authorities intervention

Blockchain for establishments

Whereas the early crypto rallies primarily got here from non-public retail buyers and merchants, institutional buyers have been becoming a member of the fray as effectively lately. From prime banks and hedge funds delving into the crypto house to fintech giants including help for digital property to their platforms, institutional adoption is not a pipe dream — it’s actuality.

Even the inside-baseball use circumstances, equivalent to JPMorgan experimenting with its non-public blockchain meant for interbank use or a gaggle of prime data and communication know-how suppliers tapping ClearX’s blockchain answer for data-on-demand companies, matter. They add additional credibility to the know-how powering the crypto ecosystem, which provides to long-term investor confidence.

Although fairly a couple of enterprise-grade blockchain initiatives will seemingly keep on non-public blockchains, the rising investor confidence within the know-how is prone to additional normalize crypto within the public eye and draw extra eyes to the general public blockchain house. Moreover, such initiatives make for a complete area of interest market of options that may assist corporations construct their non-public chains. One other area of interest could also be in bridging these non-public chains with the general public house. Crypto is, in spite of everything, all about connectivity and inclusion, so such aspirations solely make sense.

Asset managers

The primary Bitcoin exchange-traded fund (ETF) within the U.S. took off in late 2021, and the quantity of curiosity it drew from buyers is one other testimony to simply how a lot urge for food the market has for crypto publicity. Now we have come to the purpose the place some monetary advisors are recommending that everybody, no matter their age and threat preferences, ought to have at the least some publicity to crypto.

Because of a change in sentiment like that, increasingly asset managers will probably be trying into the crypto house, whether or not it’s on a shopper’s request or on their very own inclination. By the identical token, increasingly excessive earners will probably be becoming a member of the ranks of crypto buyers, bringing extra worth into the blockchain financial system.

With all due respect to ETFs and different conventional property, any crypto-savvy person will inform you that precise crypto is best than a conventional asset mimicking its actions. The rationale for that’s that crypto is way extra dynamic. Your Ethereum-pegged ETFs (if these pop up some day) will solely sit together with your dealer. With the precise cash, however, you may stake, use yield farms, and faucet varied different DeFi companies for extra passive revenue.

On this respect, will probably be fascinating to look at and see if conventional asset managers quickly begin shedding floor to crypto-native options equivalent to EQIFi, backed by EQIBank. One of many platform’s key companies is its yield aggregator, which successfully acts as an asset supervisor by allocating the person’s funds into varied DeFi protocols to ensure most returns. Such companies make crypto extra profitable as an asset class that may work for its proprietor 24/7 via platforms which are at all times accessible and take only a few clicks to handle.

Elusive Bitcoin ETF: Hester Peirce criticizes lack of authorized readability for crypto

Video games and avid gamers

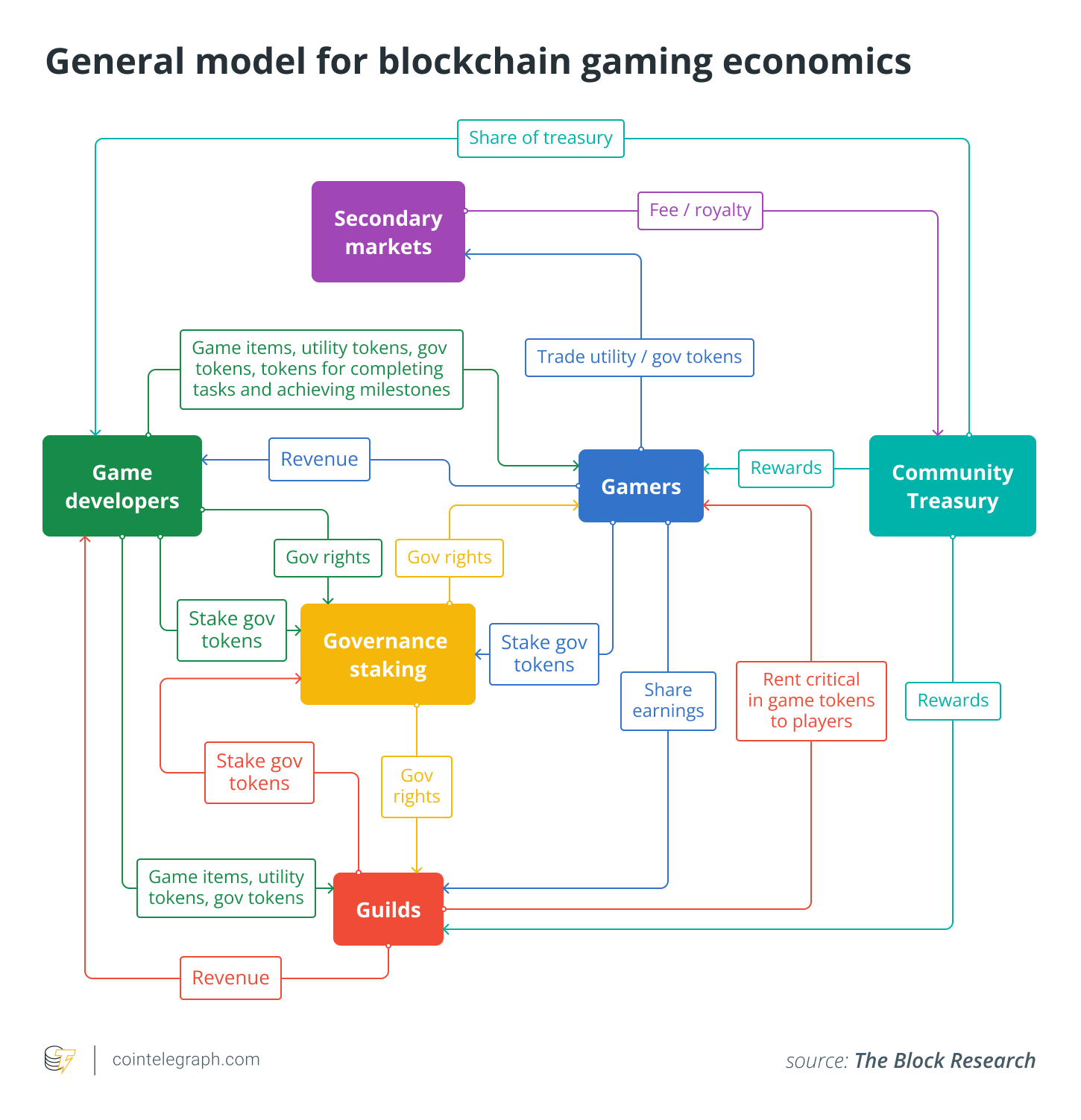

Blockchain video games usually are not precisely one thing new, as anybody who remembers the CryptoKitties craze can attest to. Nonetheless, when Axie Infinity started making headlines as folks within the Philippines turned to it looking for an revenue amid the COVID-19 pandemic, the play-to-earn trade stepped proudly into the limelight.

Now, it’s onerous to not surprise if a few of this satisfaction might have been misplaced, given the plights that Axie Infinity, the trade’s standard-bearer, is now going through. The sport has lengthy had an inflation downside as its underlying enterprise mannequin started to provide method. Including to this problem was the latest hack, one of many worst ones on report within the DeFi house.

Axie Infinity’s pains could possibly be simply one other case of a nascent trade determining its personal greatest practices. An entire host of latest initiatives is now gearing as much as transfer this house additional, aspiring to deliver it to AAA-level polish when it comes to visuals and gameplay. As soon as these new juggernauts enter the world, we’ll seemingly see extra avid gamers start to discover crypto.

It might be tempting to write down blockchain gaming off as simply one other subset of the retail market, however there’s extra to it in the long term. The online game trade is an undisputed powerhouse within the leisure world, and wherever it goes, its adherents will comply with. From esports to in-game advertisements, the normal gaming trade has already given beginning to a wide selection of satellite tv for pc markets, and all of these make for brand new use circumstances, new audiences and new enterprise alternatives.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a call.

The views, ideas and opinions expressed listed here are the creator’s alone and don’t essentially mirror or signify the views and opinions of Cointelegraph.

Ariel Shapira is a father, entrepreneur, speaker, bike owner and serves as founder and CEO of Social-Knowledge, a consulting company working with Israeli startups and serving to them to determine connections with worldwide markets.